Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers.

“[L]et’s have Bretton Woods again.” Arthur Laffer 1982

And maybe other folks, up for the Fed? Well, Judy Shelton says gold might be the way to go…

That’s from an interview Erik Brynjolffson, Tod Loofbourrow and I conducted back in 1982 for the Harvard International Review. So, if Obama’s November 2008 election could’ve caused the Great Recession that started in December 2007 (and the Lehman Brothers collapse in September of 2008) as Laffer has claimed, why not Bretton Woods redux?

Guest Contribution: “A Tale of Two Surplus Countries: China and Germany”

Today we are fortunate to present a guest contribution written by Yin-Wong Cheung (City University of Hong Kong), Sven Steinkamp (Universität Osnabrück) and Frank Westermann (Universität Osnabrück). This contribution is based on a paper forthcoming in the Open Economies Review.

CEA Chief Economist Casey Mulligan on the Eve of the Great Recession

(Well, actually, the recession had been underway for nearly ten months, and after Lehman Brothers, on October 26th, 2008). Or why I worry about the White House economic policy management team.

NO DEPRESSION; NO SEVERE RECESSION

The medium term fundamentals point toward more real GDP, more employment, and (to a lesser degree) more consumption. Some employment and real GDP declines may occur in the short run, but they will be small by historical standards. Professor Cooley recently explained “The losses to date represent less than .5% of the work force. In the relatively mild recession of 2001 to 2002, job losses equaled about 1% of the work force. In the much more severe recession of 1981 to 1982, job losses totaled nearly 3% of the labor force–six times today’s figure. And in the (truly) Great Depression–invoked, now, with an alarmist frequency–job losses between 1929 and the trough in 1933 were 21% of the labor force.” Note that 21% over 3 1/2 years is an average decline of 2% every quarter for 14 consecutive quarters! If employment declines 2% in even one quarter, or 5% over a full year, I will admit well before 2010 that a severe recession is happening and that my 2010 forecasts are unlikely to be attained.

According to the BLS, national nonfarm employment was 136,783,000 (SA) at the end of 2006, as the housing price crash was getting underway. Real GDP was $11.4 trillion (chained 2000 $). Barring a nuclear war or other violent national disaster, employment will not drop below 134,000,000 and real GDP will not drop below $11 trillion. The many economists who predict a severe recession clearly disagree with me, because 134 million is only 2.4% below September’s employment and only 2.0% below employment during the housing crash. Time will tell.

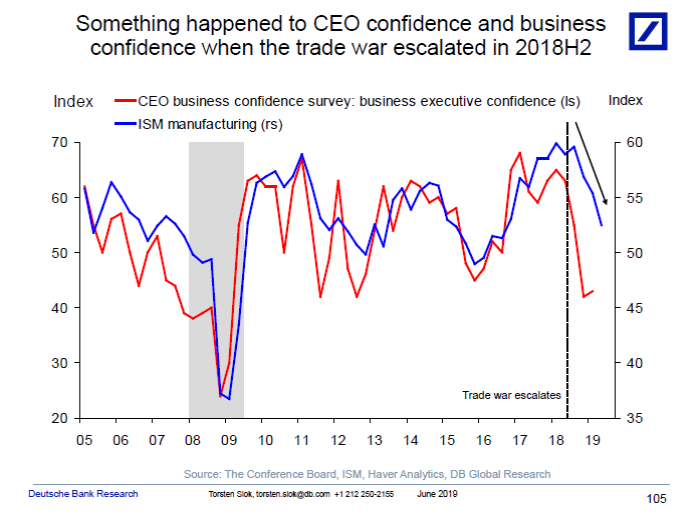

How Trade Uncertainty Is Crushing Economic Optimism

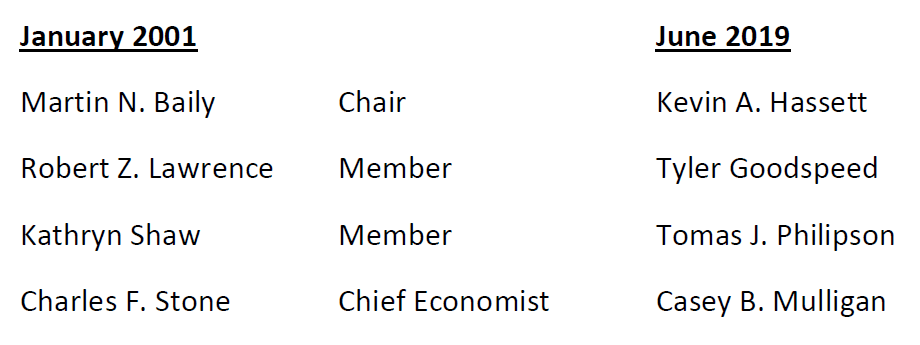

CEA Leadership, January 2001 vs. June 2019

I was reminded as I found a photo of the January 2001 CEA and staff, of how economic analysis has evolved over time in the White House.

10yr-3mo Treasury Spread Continuously Inverted since May 23rd

5yr-3mo spread continuously inverted since March 7th; let’s hope Cam Harvey‘s estimated probits are wrong this time around…(although I doubt they are).

Scary and Scarier: CFNAI

Chicago Fed National Activity Index (CFNAI) for April (May comes on June 24th).

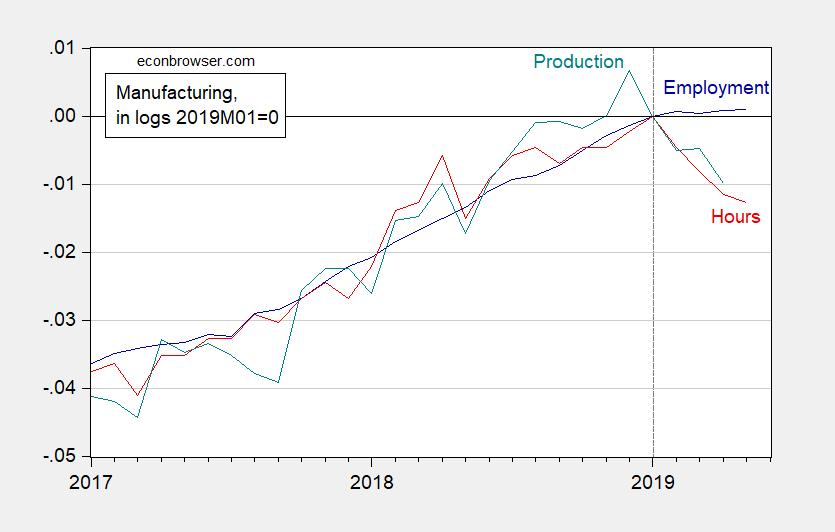

Manufacturing Peak?

With trade volumes flat or trending down worldwide, what to make of US manufacturing?

Figure 1: Manufacturing employment (blue), aggregate hours of production and nonsupervisory workers (red) and production (teal), in logs 2019M01=0. Source: BLS, Federal Reserve via FRED, and author’s calculations.

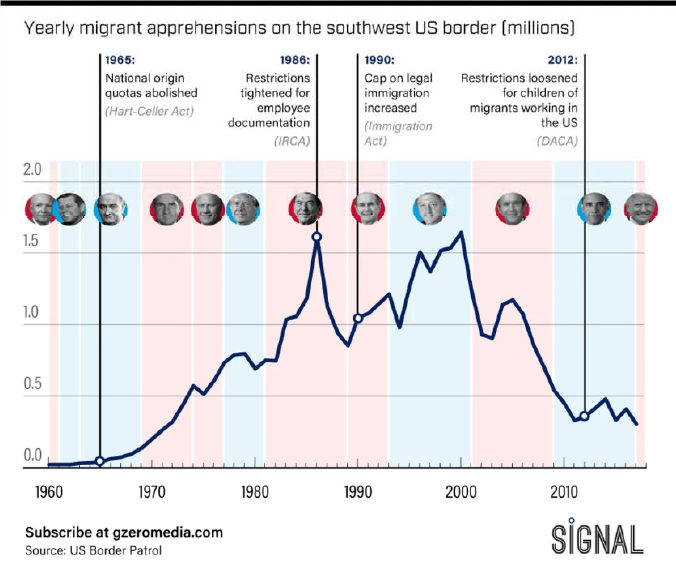

Why We Are Letting Children Die In, and Building Bigger, Detention Camps

…as well as threatening an all out trade war with Mexico. It’s purportedly to deal with the “migration crisis” on our Southern border. The “crisis” is illustrated below.

Source: Gzeromedia.

Update, 9:45PM Pacific: Several commenters have called for a wall. I suspect they would prefer machine gun posts, a few dozen tanks each mile, some antipersonnel mine fields, and a “shoot-to-kill” order from Trump to accompany the wall.

Here is some reasoned analysis of the southern Wall, from EconoFact.

Should the United States Build a Wall on the Mexican Border to Reduce Unauthorized Immigration?