This despite Trump’s temporary delay on additional China tariffs.

Teaching Begins Early This Fall: News, Efficient Markets Hypothesis, Asset Prices

Figure 1: September 2019 corn futures, accessed 8/13/2019. Source: Barchart.com.

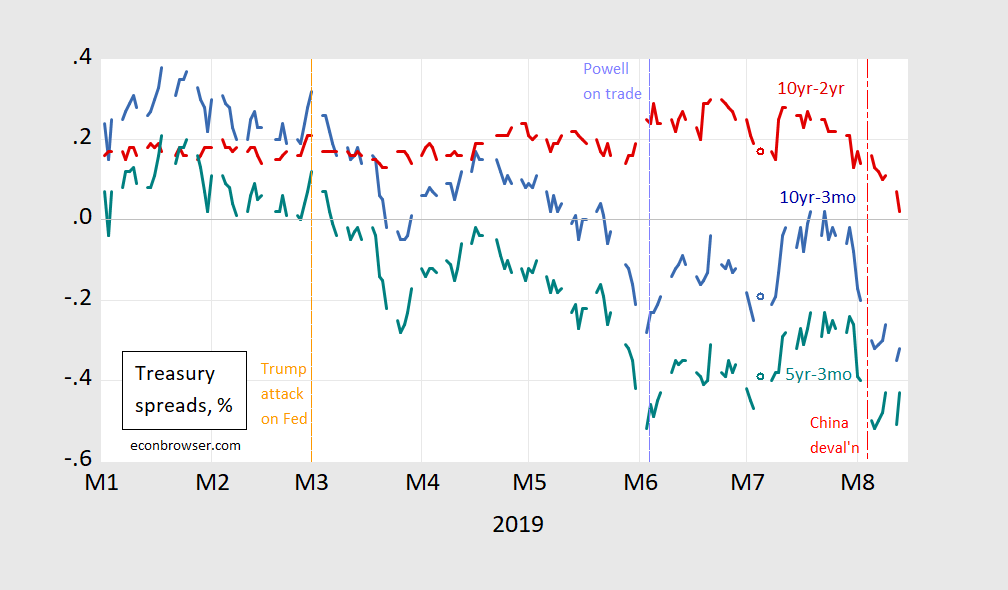

Term Spreads Plumb New Depths as Long Yield Drops

A picture is worth a thousand words.

Guest Contribution: “RMB reaches 7.0; US names China a manipulator”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate on August 9th.

On the Eve of Recession? Five Graphs from Two Courses

I get to teach Public Affairs 854, “Macroeconomic Policy and International Financial Regulation” and Economics 435 “The Financial System” this fall. There’s a cosmic confluence this year, in terms of the subject:

Undervaluation, Misalignment, and China in the 2019 IMF External Sector Report

Donald Trump’s pronouncements can typically be taken as contra-indicators. In other words, what he says is invariably wrong. So, you gotta wonder on China…

Continue reading

SitRep from the Midwest

No end to “the blip“. From today’s Des Moines Register:

The Journal of Economic Perspectives in the Classroom

A collection of JEP articles readers have cited as useful for instruction, by category:

The Never-Ending Blip

On July 9, 2018, almost exactly a year ago, reader CoRev wrote:

Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

Prospects for a Resolution to the US-Trade Dispute Inferred from Soybean Futures

Asset price movements around “news” regarding policy can illuminate the market’s assessment of the outlook for trade policy. Looking at a small window (say half hour) around an event can allow one to separate other factors (weather, other demand factors) from other. With that, let’s look at soybean futures (September 2019)…