[Inflation adjusted] Personal income excluding transfers and industrial production are falling in October, even as employment rises in November.

Private nonfarm employment: BLS vs. ADP

The trajectories of the BLS vs. ADP private nonfarm employment series differ, even though for much of the year, the ADP series was above that of BLS.

Probability of Recession: In 12 Months vs. Within 12 Months

With increasing term spreads (or, steepening of the yield curve), fears of imminent recession have waned. Does this make sense?

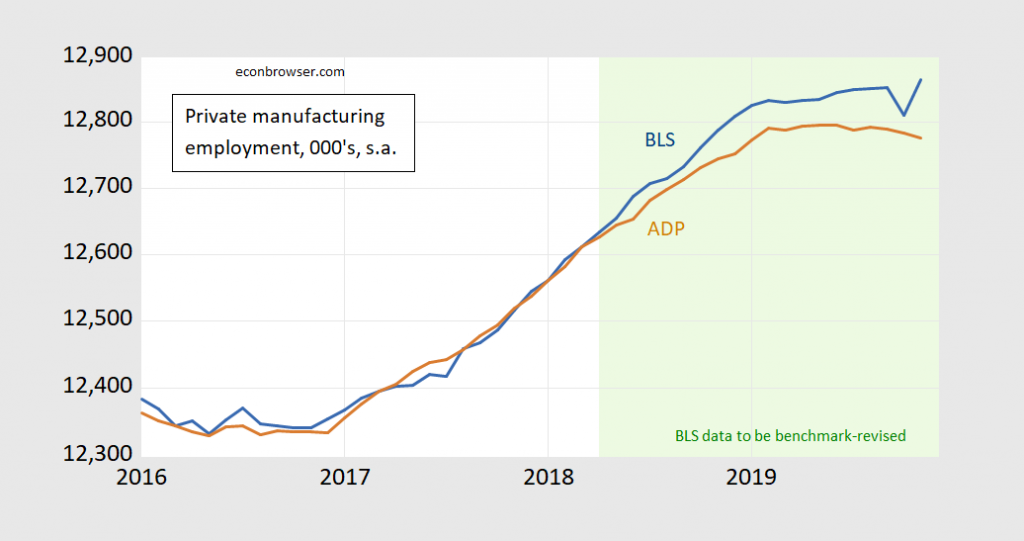

Manufacturing Employment: BLS vs. ADP (updated to incl. Nov BLS)

Figure 1: Manufacturing employment, in 000’s, s.a., from BLS (blue), and from ADP (brown), on log scale. Light green shading denotes data that will be benchmark-revised in February release. Source: BLS and ADP via FRED. [Updated 12/7 to include November BLS data]

Manufacturing peaked a little earlier in the ADP data (June) vs. BLS (August), but ADP suggests a much less pronounced rise to peak during 2019.

Guest Contribution: “Is capital flow management effective? Evidence based on U.S. monetary policy shocks”

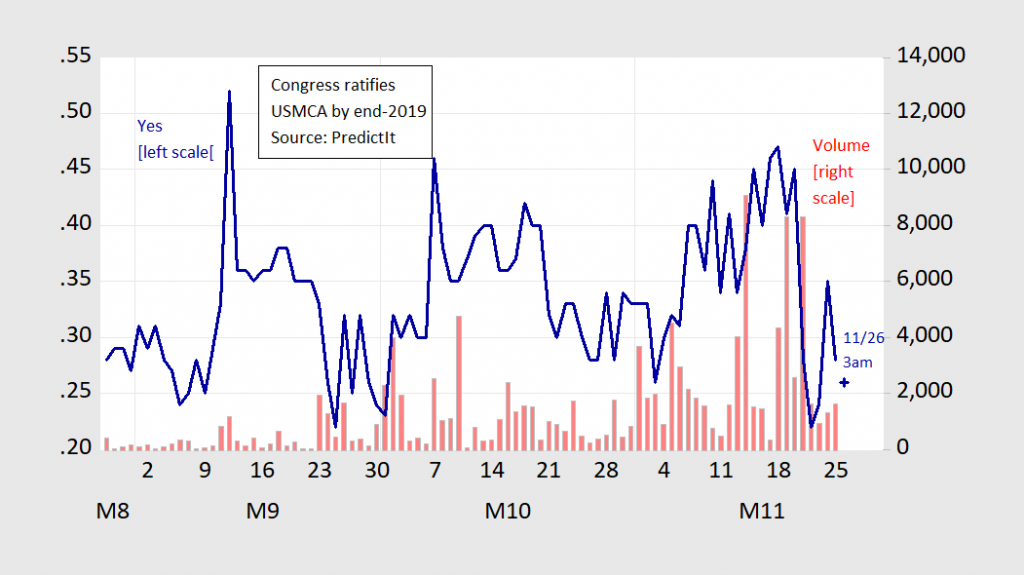

An Event Study: Trade Truce-Part 1, or Not?

See if you can find when Trump makes his statement about trade negotiations with China. Winning!

Guest Contribution: “Let’s Go Back to Good Old Tariff-Cutting”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

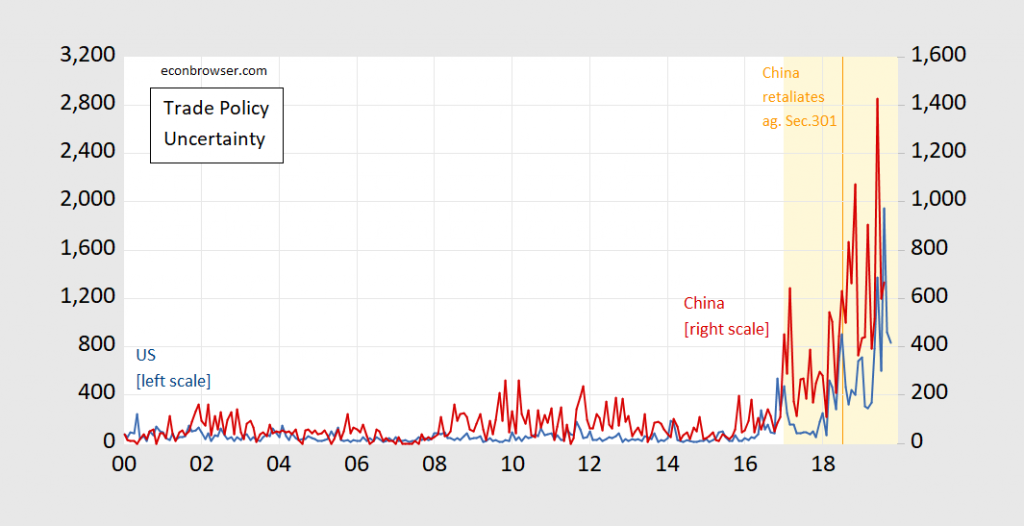

Trade Policy Uncertainty: US, China

Foxconn as Case Study of Targeted Development Subsidy

Or, “Ready, fire, aim”. From Mitchell et al. “The Economics of a Targeted Economic Development Subsidy,” Mercatus Center: