Back in July 2018, reader CoRev wrote:

…no one has denied the impact of tariffs on FUTURES prices. Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

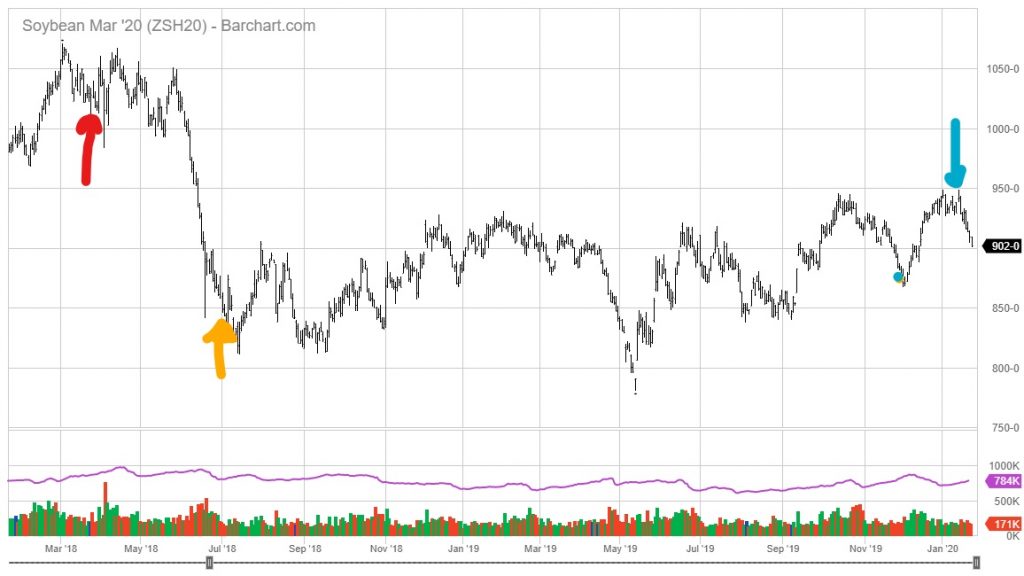

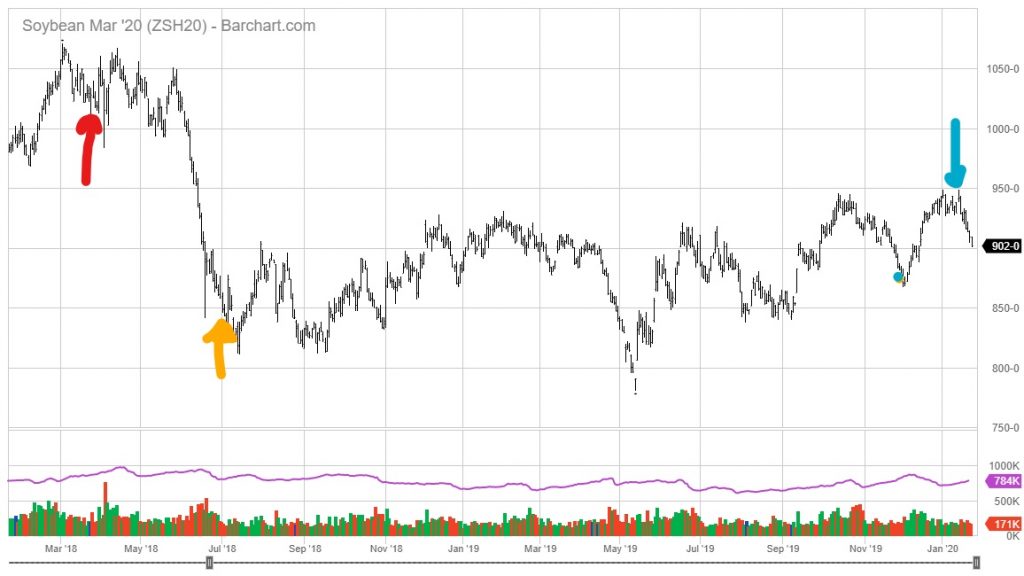

Back on March 23rd, when Mr. Trump announced intent to launch Section 301 actions, nearest month soybean futures closed at 1028. Latest today is 902. Indeed, prices have been falling since Mr. Trump signed the much heralded (by some) Phase 1 deal. This is shown in Figure 1 below.

Figure 1: Front month soybean futures (black). Trump announces intent of Section 301 action against China (red), Section 301 tariffs and Chinese retaliation in effect (orange arrow), and Phase 1 deal signed (blue arrow). Source: barchart.com.

Front month futures prices are now 14% lower now, while the CPI is 2.2% higher (both in log terms). You can do the math. The “blip” is not over.