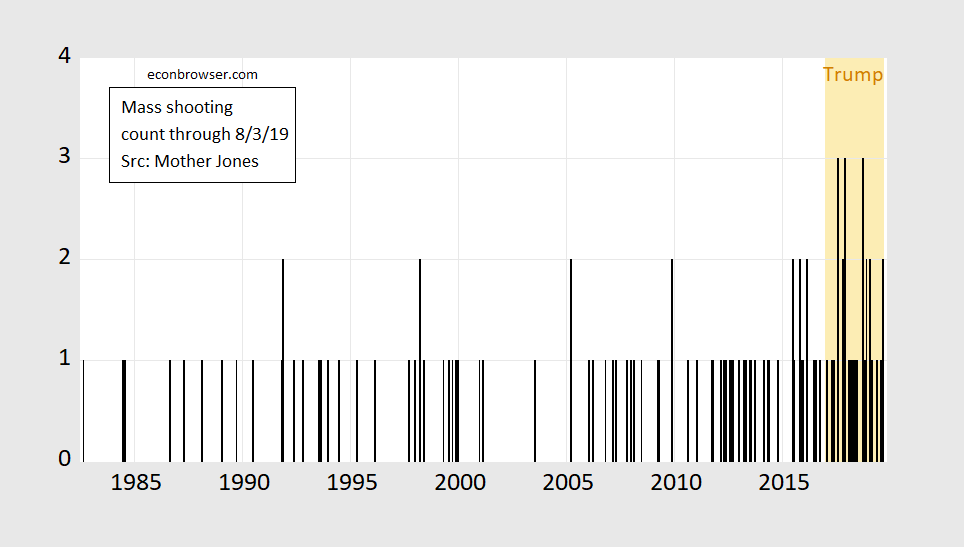

Poisson regression, 1982M08-2019M08 (thru 8/4 for August):

eventst = -9.84 + 0.723 trumpt – 0.424 bant + 0.0039 time

Adj-R2 = 0.17, SER = 0.480, NOBS = 445. Bold denotes significant at 10% msl.

Addendum, 8/6 8am Pacific: events is mass shooting event count as defined by Mother Jones tabulation, ban is assault weapons ban dummy, trump is a Trump administration dummy, time is a linear time trend.

Interpretation: Each month of the Trump administration is associated 0.7 more mass shooting events 70% more mass shooting events, so jumping from 0.43 to 0.88 events going from 2016M12 to 2017M01; or approximately 5.4 more events per year 8.4 more events per year. [h/t Rick Stryker for correction of interpretation].