Today, we are pleased to present a guest post written by Laurent Ferrara (Banque de France), Céline Poilly (AMSE) and Daniele Siena (Banque de France). The views presented represent those of the authors, and not necessarily those of the institutions the authors are affilliated with.

“Across-the-Board Tariffs on China with Retaliation and Federal Spending Create Over 1 Million Jobs in Five Years”

The Coalition for a Prosperous America publishes another study imbued with “secret sauce” structure…From the “working paper” (more akin to a press release):

Specifically, we introduce the effects of Chinese retaliation with tariffs on US exports to China; we add the effects of the US Department of Agriculture’s (USDA) programs to support farmers and food processors negatively affected by Chinese retaliation; and, we add the impact of the US government spending the revenue generated by the China tariffs. We find that Chinese retaliation reduces the benefit to the US economy by 14 percent, but the net benefit remains large. The USDA programs provide relief to the agricultural industry and restore the net benefit to almost the same level as before the retaliation. Finally, we look at the impact of the government reinvesting the tariff revenue in the US economy by boosting government spending…

Them’s Fightin’ Words: Futures, Mean Squared Error, Mean Absolute Error

For some reason, my use of commodity futures as predictors of future spot prices for commodities (e.g., soybeans) incites fire and fury from some Econbrowser readers. Hence, I want to cite another example of the use of futures.

Judy Shelton Confuses Me (Part 2,432,671)

Fed Nominee-to-be Judy Shelton responds to her issues with government statistics (Long, Davies, WaPo):

In a series of e-mails, Shelton defended her views, saying that she remains “skeptical about the accurancy and consistency” of economic statistics because they do not always capture technological innovation accurately. She added that “we need to be sure that data used for policy-making decision is accurate and appropriate.”

However from the context of her 2015 talk (see tape, at 1:07:07) it’s pretty clear from how she responded to the question, she thought the government statistics were understating inflation. Yet her supposedly exculpatory statement regarding technological innovations is consistent with an enormous literature that addresses concerns that government price statistics overstate inflation (review, Boskin Commission; more recently in digital context, see here). In other words, I still get the impression that Dr. Shelton disbelieves the government statistics because, well, they’re government statistics, and not because of any deeply held convictions regarding hedonic adjustments for quality, etc. in the CPI or other price indices. (A Google Scholar search fails to detect any Shelton writing on quality/measurement issues and deflators and/or productivity statistics).

An interesting paper on the subject of incorporating digital products into the national accounts, by Brynjolfsson et al. (2019).

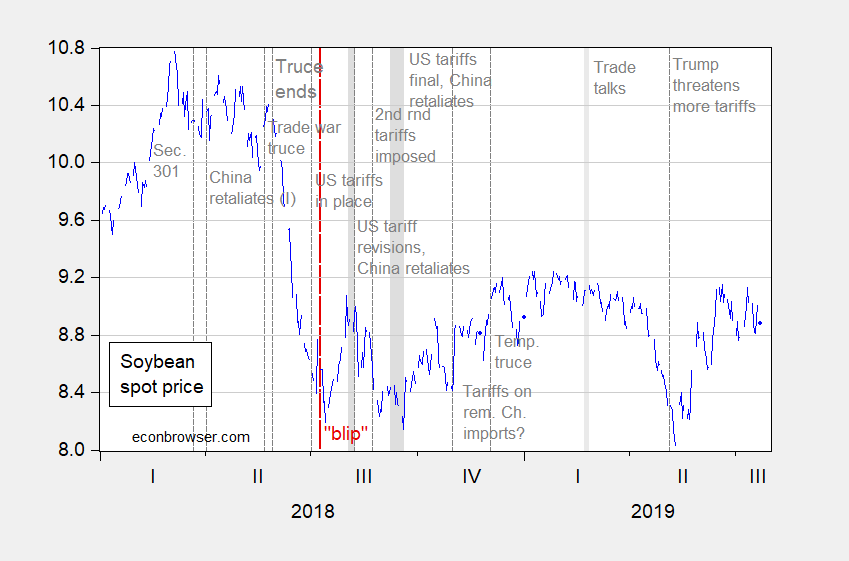

A Year-Long Blip

Figure 1: Soybean spot prices. Source: Macrotrends.com, accessed 7/23/2019.

Back on July 9th of last year, an Econbrowser reader wrote:

Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

Needless to say, prices are not back to where they were in Sept-Nov 2017. Instead, Brazil has siezed market share and US soybean shipments to China have plummeted. From USDA FAS “Oilseeds”, on July 11th:

“International spillovers of monetary policy through global banks”

That’s the title of a new special issue of the Journal of International Money and Finance, co-edited by Claudia Buch, Matthieu Bussière, Menzie Chinn, Linda Goldberg, Robert Hills, drawing on proceedings from an International Banking Research Network conference. From the introductory paper:

International spillovers of monetary policy have been core topics of theoretical and applied work in recent years, and thesubject of intense discussions in policy circles. Recent literature has improved our knowledge of international policy trans-mission, for instance: by investigating the role of global liquidity conditions; by analyzing international bond price orexchange rate responses to monetary policy decisions using very high frequency data and identification of monetary shocks;and by assessing countries’ monetary policy autonomy by examining the interest rate co-movements with base country pol-icy instruments. Still, gaps in this literature persist. In particular, most of the literature has focused on macroeconomic chan-nels, whereas comparatively less attention has been paid to transmission via banks, which may vary depending on individual banks’ characteristics and the features of national banking systems.

Against this background, the International Banking Research Network (IBRN) launched a project aimed at closing some ofthese gaps, drawing on a unique network of researchers and data. Country teams compiled individual bank-level data for theperiod from 2000 through 2015, usually based on confidential data proprietary to central banks, and then analyzed thosedata using a common empirical method. Small groups of country teams collaborated on papers to bring out instructive com-parisons and contrasts about the way in which monetary policy can have effects across borders via banks.

Recession Indicators as of July 21

Industrial production is down relative to previous month, and relative to recent peak. GDP, sales, personal income are all below recent peak as well. Nonfarm payroll employment continues to plug along — although at a decelerating pace (1.53% y/y).

Is California in Recession (Part XVII)

June employment figures are out. Time to re-evaluate this assessment from one and a half years ago in Political Calculations that California was in recession.

Going by these [household survey based labor market] measures, it would appear that recession has arrived in California, which is partially borne out by state level GDP data from the U.S. Bureau of Economic Analysis. [text as accessed on 12/27/2017]

What Does Judy Shelton Believe GDP Growth and Inflation Are in 2019?

In a 2015 Cato Institute session, Fed Board Nominee Judy Shelton discusses whether to trust or not official GDP and inflation statistics (she says no — see 1:07:07) (h/t Sam Bell).

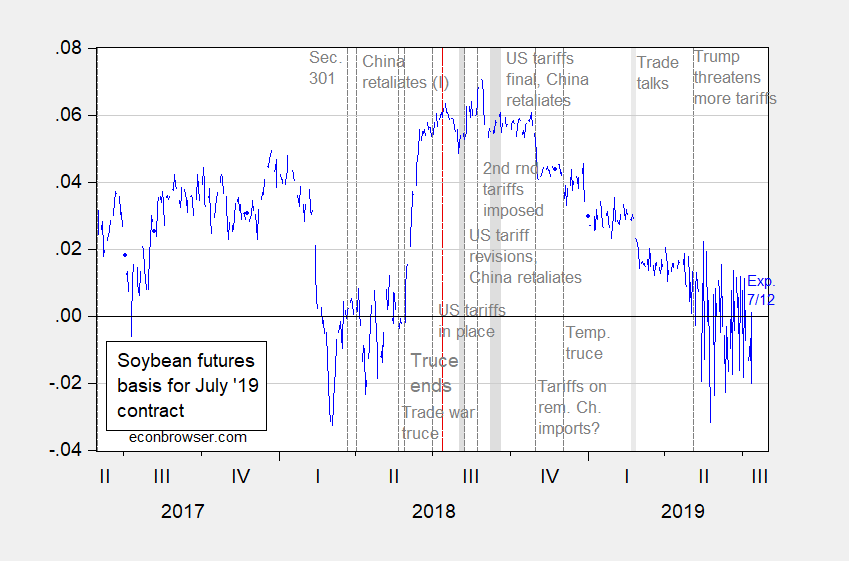

The Course of the US-China Trade War, Viewed through the Lens of Soybeans

Or, hope died in August 2018…

Figure 1: (Log) July 2019 soybean futures contract price minus spot price (blue). Source: ino.com and macrotrends.com, and author’s calculations. Red dashed line at 7/12/2018, one year before expiration of July 2019 futures contract. Dates from Dezan Shira and Assoc.

Typically, the futures and spot should differ by cost of carry, but for soybean futures, but at the 3, 6 and 12 months horizons, the futures are an unbiased predictor of future spot rates (see Chinn and Coibion, 2014). Hence, the spread can (roughly) be interpreted as an estimate spot rate rising in the future, which is inversely proportional to the probability of a resolution of the US-China trade war (cost of carry is going to vary over the year, so the spread is only partly indicative).

For the course of the spot and July 2019 futures, see this post.