Today, we are pleased to present a guest contribution by Ann Markusen, Professor Emerita and Director Arts Economy Initiative and Project on Regional and Industrial Economics at the Humphrey School of Public Affairs at the University of Minnesota.

Killing the Messenger (on Climate)

From WaPo today:

The Trump administration has decided to disband the federal advisory panel for the National Climate Assessment, a group aimed at helping policymakers and private-sector officials incorporate the government’s climate analysis into long-term planning.

Wisconsin Employment below April Levels, Minnesota Surges

State agencies have released data on July employment. Below is Wisconsin, compared to Minnesota and the Nation.

Not Foxconn in the Henhouse

But maybe Walker in the henhouse.

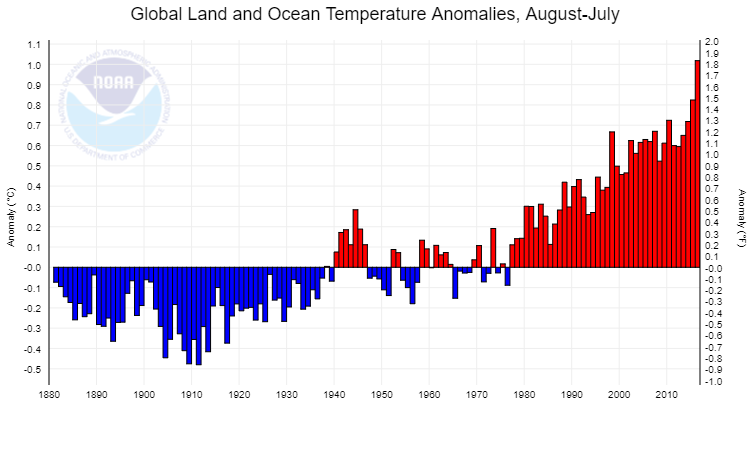

12-Month Global Temperature Anomaly, July 2017

Source: NOAA.

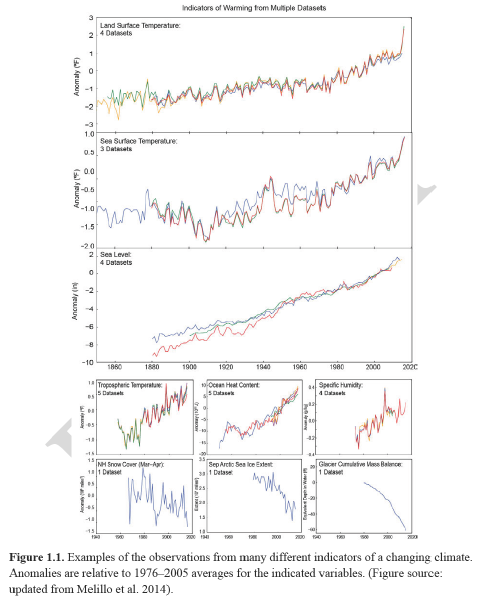

Draft Report on Climate Change

Growth Expectations Pre- and Post-Election

In response to my assertion growth expectations popped up post-election, and have subsequently receded, Reader Neil writes:

Did the consensus ever price in an economic boom in the US? Growth expectations in the US for 2017 did not shift, at least according to Blue Chip – essentially flat at 2.2%. …

I was intrigued by this comment, so I followed up. In particular, I focus on 2018, presumably when anticipated fiscal and/or other policies would kick in (the ten year-three month yield curve pertains to a year ahead):

Asset Prices and Economic Policy Uncertainty, Post-Election

The economy plugs along much as it did before the election, while the stock market hits new highs. What about other variables?

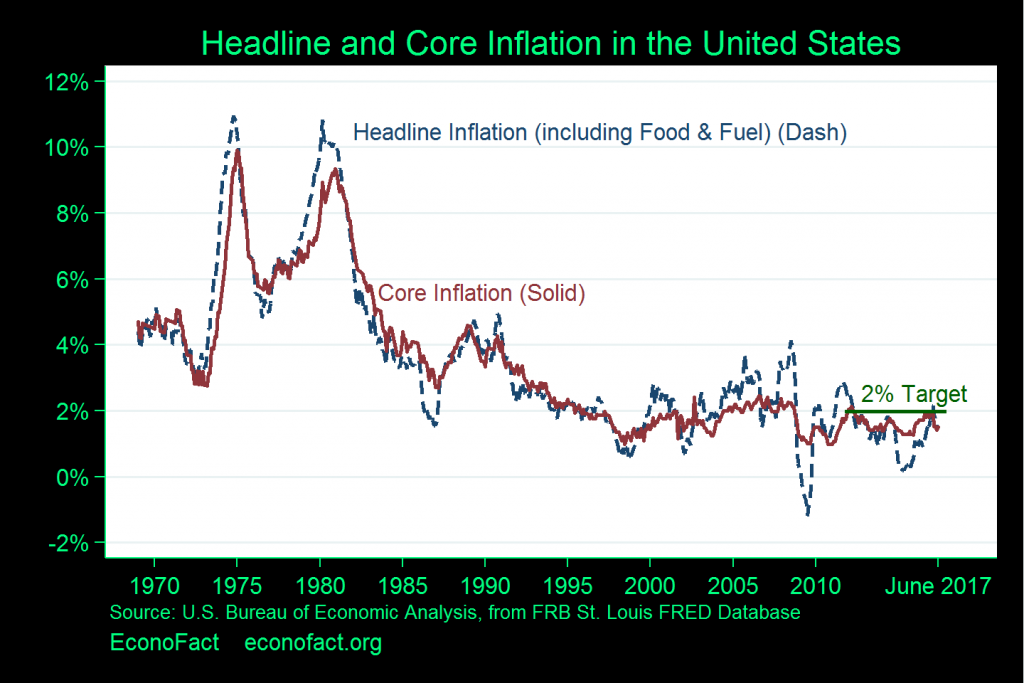

“What’s the Problem with Low Inflation?”

That’s the title of a new EconoFact article by Michael Klein.

Today’s low inflation has some economists puzzled. The Federal Reserve has persistently undershot its inflation target of 2 percent since 2012, when it established this level of inflation as one of its policy goals.

…

Low inflation can be a signal of economic problems because it may be associated with weakness in the economy. When unemployment is high or consumer confidence low, people and businesses may be less willing to make investments and spend on consumption, and this lower demand keeps them from bidding up prices.…

There have been calls for the Federal Reserve to raise interest rates because the ongoing recovery from the Great Recession represents the third-longest recovery on record and the current low unemployment rate would usually lead the Federal Reserve to set its policy course towards preventing the economy from overheating. It is striking, however, that this recovery has not been accompanied by increasing inflation, even with unemployment rates of 4.3 percent in June and July, the lowest string of two-month unemployment rates in more than 15 years.

This figure from the article highlights the anomalous nature of recent inflation behavior.

Source: Klein.

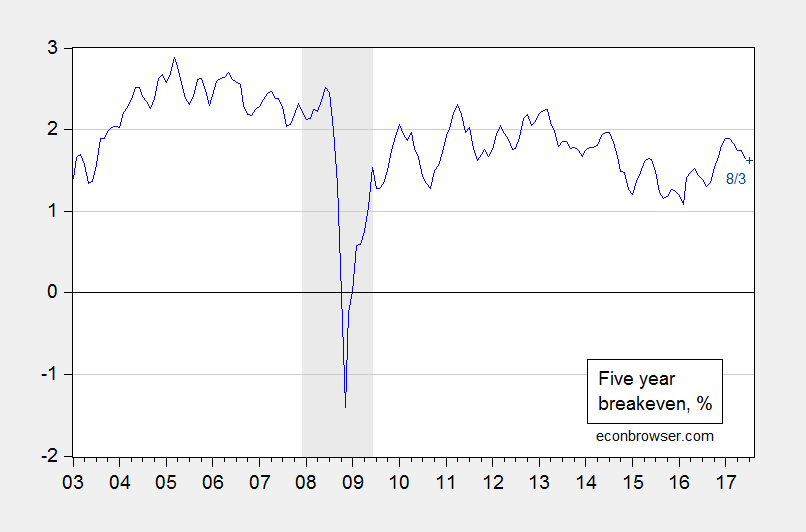

What are the prospects for accelerated inflation? The market’s expectation inferred from Treasury spreads is shown below:

Figure 1: Five year nominal Treasury yield minus five year TIPS yield, % (blue). July 2017 observation (dark blue +). Source: Federal Reserve Board.

As noted, such quiescent current and expected inflation at (what is widely acknowledged to be) near full employment does pose something of a mystery.

In the past, I’ve argued that the inflation target should be higher than the current 2%. [1] [2] I still believe that’s the case.