It’s that time of year again! By which I mean, the once-in-a-lifetime opportunity to enter the eleventh annual Econbrowser NCAA tournament challenge! All right, so last year you had a chance to enter the tenth annual challenge, which was kind of similar. But whether or not you tried it last year, here’s an all new roll of the dice to see how well you can predict the outcome of this year’s U.S. college men’s basketball tournament. If you want to participate, go to the Econbrowser group at ESPN, do some minor registering to create a free ESPN account if you haven’t used that site before, and fill in your bracket before Thursday at noon!

The New Fama Puzzle, post-ZLB

In a previous post, I documented the fact that the Fama puzzle had transformed post-global financial crisis, so that for most currency pairs, interest rate differentials pointed in the right direction for subsequent exchange rate depreciation, from 2006 through end-2015 (Bussiere, Chinn, Ferrara, Heipertz (2018)). Here I show that the new puzzle persists through the end of 2017, a period when US interest rates were rising.

Wisconsin, Trade and Section 232

I was interviewed on the weekly newsmagazine Here and Now today about Mr. Trump’s tariffs on steel and aluminum:

Regarding Wisconsin, cheese was not on the Hit List, but motorcycles and cranberries were.

Some Steel Sector Indicators

which should give you pause for thought about national-security-rationalized tariffs. Output stable, real prices up.

Nearly 35 Years of Daily EPU Data, Plotted

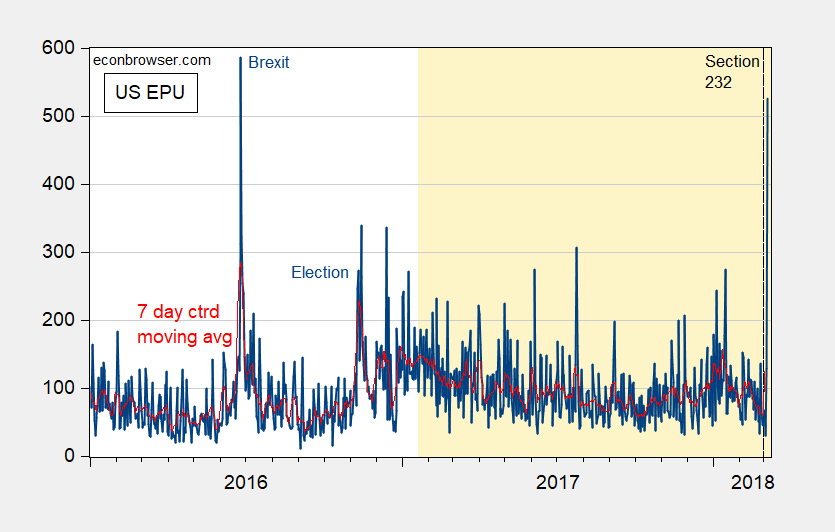

Ed Hanson asserts that by showing a plot of monthly data constructed as an average of daily data, I am changing the message of the data. In order to assure people that the Trilateral Commission/the Illuminati/CigaretteSmokingMan haven’t “gotten to me” to manipulate the data, I’m going to show permutations of the Baker/Bloom/Davis Economic Policy Uncertainty (EPU) data, news based index.

Is Trump “Special”? Economic Policy Uncertainty Levels in Perspective

The answer is “yes”.

Economic Policy Uncertainty and Risk Indices: March 5, 2018

Remember those quaint notions of policy uncertainty holding back growth? Well, what to make of recent moves in uncertainty and risk indices, given all the talk of trade wars?

Figure 1: US daily Economic Policy Uncertainty index from Baker, Bloom and Davis (dark blue), and seven day centered moving average (red). Orange shading denotes Trump Administration. Source: policyuncertainty.com, and author’s calculations.

An Event Study: How Do Equity Markets View National Security-based Trade Protection?

Figure 1: Dow Jones, 15 minute increments. Source: TradingEconomics.

Thanks, Trump: Wisconsin Cheese Edition

Mr. Trump has stated his intention of raising tariffs on steel and aluminum, based on national security grounds. See this post on the specious aspects of this argument, and this recent EconoFact column on the hits to the economy that would result from steel tariffs. The EU has hinted at striking at Wisconsin cheese in retaliation (Wisconsin is the second largest state exporter). This makes perfect sense from a strategic perspective – agriculture is America’s comparative advantage, and Wisconsin’s Representative Paul Ryan is Speaker.