New data came out on industrial production and monthly GDP over the last couple days. That allows us to update the picture of key indicators that the NBER Business Cycle Dating Committee focuses on continues to paint an ambiguous picture.

“Balance Sheet Effects on Monetary and Financial Spillovers: The East Asian Crisis Plus 20”

That’s the title of a new paper written by me, Joshua Aizenman and Hiro Ito:

Why you should never use the Hodrick-Prescott filter

A common problem in economics is that most of the variables we study have trends. Even the simplest statistics like the mean and variance aren’t meaningful descriptions of such variables. One popular approach is to remove the trend using the Hodrick-Prescott filter. I’ve just finished a new research paper highlighting the problems with this approach and suggesting what I believe is a better alternative.

Continue reading

Does the Aerospace Decline Explain the Kansas Collapse?

Ironman at Political Calculations thinks so. Unfortunately, in his calculation of Kansas GDP excluding agriculture and manufacturing, he made an error by simply subtracting (chain weighted) real agricultural output and real manufacturing from real GDP (as discussed in the addendum to this post; note that Ironman has never to my knowledge acknowledged this error). I’ll re-examine the importance of the shocks to the aerospace industry in Kansas to the slow pace of Kansas growth by looking at contributions to GDP growth, and contributions to employment growth.

Early Macro News and Lessons from the Brexit

Does Drought Explain the Kansas Collapse?

Ironman at Political Calculations asserts it does. Unfortunately, he makes a mistake in calculating Kansas GDP ex.-agriculture by simply subtracting chained agriculture from chained state GDP (discussed in the addendum to this post). Here in Figure 1 is properly calculated GDP ex.-agriculture plotted against a drought index (lower values is a more severe drought).

Currency Casus Belli?

Is a current undervaluation of the Chinese yuan plausible?

Recession Watch, August 2016

The implications of the tradables sector, the dollar, and Fed policy.

Observational Equivalence? Conspiracy Theory Kooks vs. Statistical Incompetence

Remember this Political Calculations blogpost asserting that BEA, by virtue of releasing statewide GDP figures, was unwittingly telegraphing a massive downward revision in GDP come the July 29th benchmark revision? That development failed to occur. In fact GDP was on average revised up release [pdf].

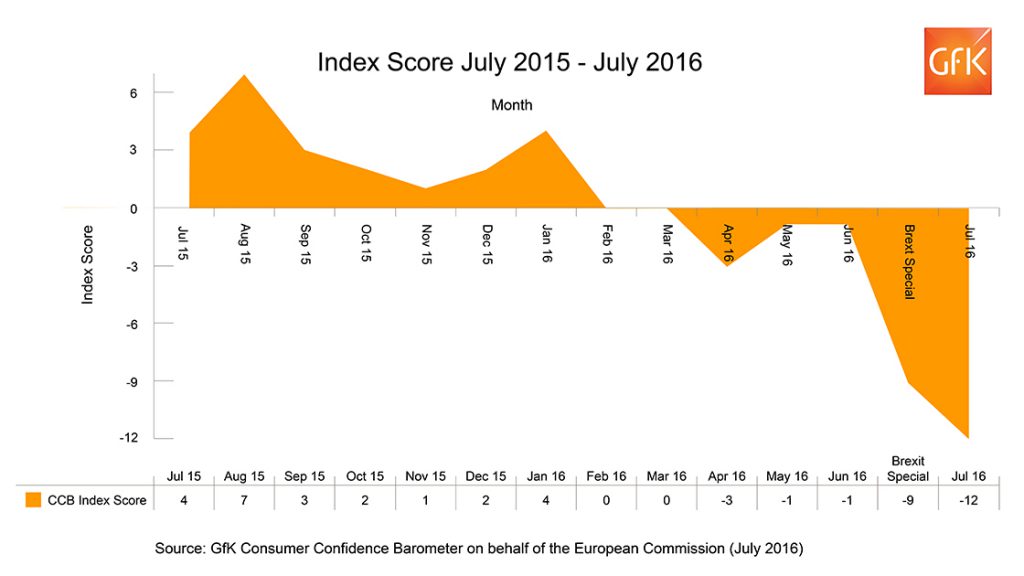

Brexit Fallout: Consumer Confidence Collapses

From GkF on Friday:

GfK’s long-running monthly Consumer Confidence Index dropped 11 points in July (since the June interviews conducted before the Referendum) from -1 to -12. The survey dates back to 1974 and July sees the sharpest month-by-month drop for more than 26 years (March 1990). This is also a further 3-point drop from the -9 recorded by the Brexit Special in early July. All five measures used to calculate the Index saw decreases this month.

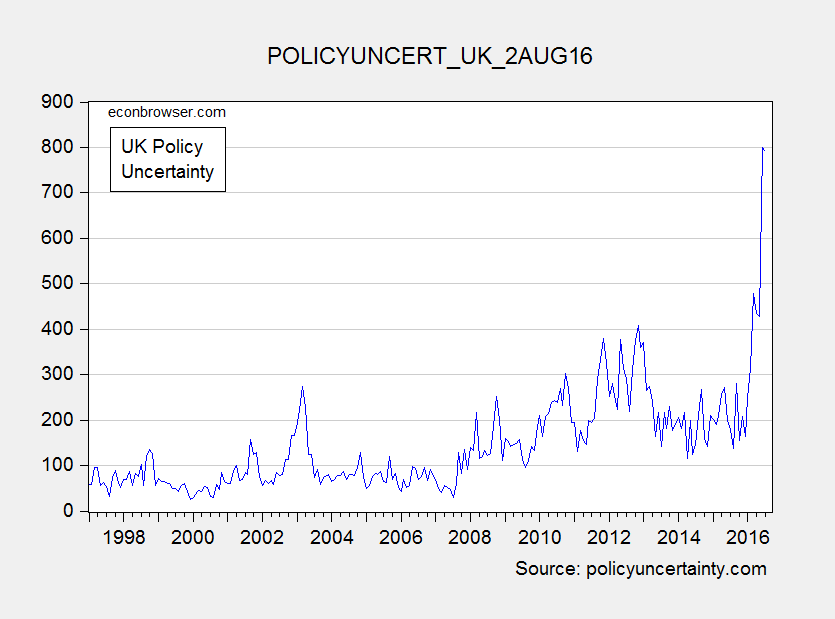

Update, 8/2 1:45am Pacific: And here is measured policy uncertainty in the UK.

Figure 1: UK Policy Uncertainty. Source: policyuncertainty.com accessed 8/2.