Now that the dust has (kind of) settled on exactly what is and is not in Gerald Friedman’s interpretation of the Sanders economic plan, I thought it useful to contrast the textbook (at least the one I use, Olivier Blanchard/David Johnson‘s) view of how a fiscal stimulus works, versus that in which a one-time spending increase yields a permanent increase in output, in a graphical format.

Mass Shooting Statistics, 3/3/16

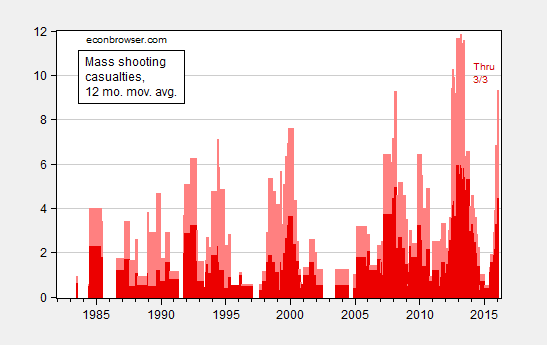

Figure 1: 12 month moving average of mass shooting casualties; deaths (dark red), wounded (pink). Source: Mother Jones, GunViolenceArchive.org. for 2/26/2016 data, and author’s calculations.

For a per capita depiction, see this post. The upward trend is obvious there as well.

“Is Currency Devaluation Overrated?”

That’s the title of a symposium in the current issue of The International Economy. Martin Feldstein, Ted Truman, Joe Gagnon, Bill Cline, Mohamed El-Erian, Cathy Mann, and José de Gregorio (among many others) contribute.

Economic Slack, Again

I keep on seeing comparisons between the Great Depression and the Great Recession (e.g., [1]), and how a big fiscal stimulus could result in a big and sustained jump in output. I think it useful to visually compare the extent of downturn in both cases.

Forward guidance

According to economic theory, one of the most promising ways in which monetary policy might be able to stimulate an economy in which the nominal interest rate has reached zero is to promise to follow a different policy rule once interest rates are again positive. A commitment to more stimulus and inflation in the future regime could in principle influence expectations and actions of people in the economy today, and thereby offer a means by which the central bank could help an economy recover from the zero lower bound. But as a practical matter, how does the Fed communicate to the public at date t something it intends to do at some future date t+h?

Continue reading

Guest Contribution: “Who is right on US financial reform? Sanders, Clinton, or the Republicans?”

Today we are pleased to present a guest contribution written by Jeffrey Frankel, Harpel Professor of Capital Formation and Growth at Harvard University, and former Member of the Council of Economic Advisers, 1997-99. This post is an extended version of a column that appeared in Project Syndicate.

Guest Contribution: “How to Mitigate Adverse Spillovers from BRICS? Role of Policies”

Today we are pleased to present a guest contribution written by Raju Huidrom, M. Ayhan Kose, Franziska Ohnsorge, and Lei Sandy Ye, all of the World Bank. The findings, interpretations, and conclusions expressed in this article are entirely those of the authors. They do not necessarily represent the views of the World Bank, its Executive Directors, or the countries they represent.

Implied Output Response to Demand Side Shifts in the Friedman Scenario under Local to Potential Assumptions

What does a conventional (estimated) macroeconometric model imply for a sustained 7.7% increase in government consumption and investment as a share of GDP in terms of output.

Guest Contribution: “Argentina: A Big Change with Problematic Initial Conditions”

Today, we are pleased to present a guest contribution written by Maria Muniagurria, faculty member in Economics at the University of Wisconsin – Madison.

A little over two months ago, Mauricio Macri began his tenure as president after his coalition of center-right parties prevailed over the ruling party’s candidate by a small margin.

Stock prices and oil prices

Ben Bernanke weighs in on why stock prices and oil prices have been moving together recently.