That’s the title of a new, and illuminating, report written by Eswar Prasad. The entire report is here. This is a must-read for those interested in RMB internationalization.

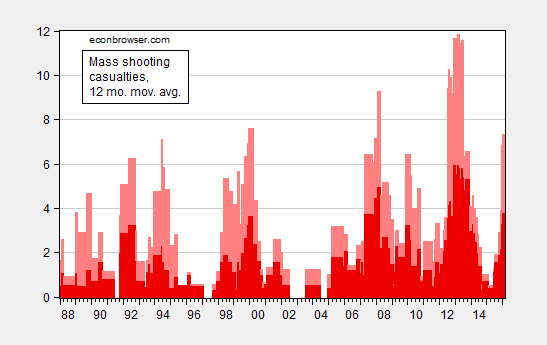

Mass Shooting Casualties Trending Up (Again)

Figure 1: 12 month moving average of mass shooting casualties; deaths (dark red), wounded (pink). Source: Mother Jones, GunViolenceArchive.org. for January 2016, and author’s calculations.

Update, 2/5 1:45PM Pacific: Title amended to address m4570d0n‘s pedantic comment.

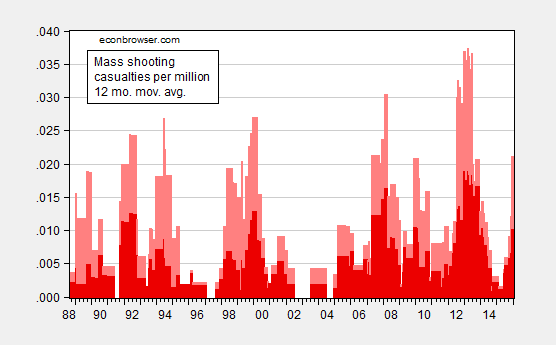

Update, 2/6, 10:30AM Pacific: Reader joe argues per capita figures would be more intuitively accessible. Here is the relevant graph.

Figure 2: 12 month moving average of mass shooting casualties per million; deaths (dark red), wounded (pink). Source: Mother Jones, GunViolenceArchive.org. for January 2016, and author’s calculations.

Note: Mother Jones used a 4 death threshold for definition of mass shooting; I have used that criterion for tabulating January 2016 numbers.

Guest Contribution: “The ECB and the Fed: A Comparative Narrative”

Today, we are fortunate to present a guest contribution written by Dae Woong Kang, Nick Ligthart, and Ashoka Mody, Charles and Marie Visiting Professor in International Economic Policy, Woodrow Wilson School, Princeton University.

Continue reading

Philadelphia Fed Coincident Indices: National, Regional and State Trends

More states are slowing even as the Nation continues to expand. The states that contracted include Wisconsin and Kansas, states pursuing a contractionary fiscal policy. Wisconsin’s level of activity lags that predicted by historical correlations.

The U.S. is not in a recession

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 0.7% annual rate in the fourth quarter. That’s a bad quarter to be sure, and real GDP is up only 1.8% from a year ago. That’s a weak year judged by the U.S. postwar average of 3.1%, but is not far from the 2.1% annual growth we’ve been averaging since 2009:Q3.

Continue reading

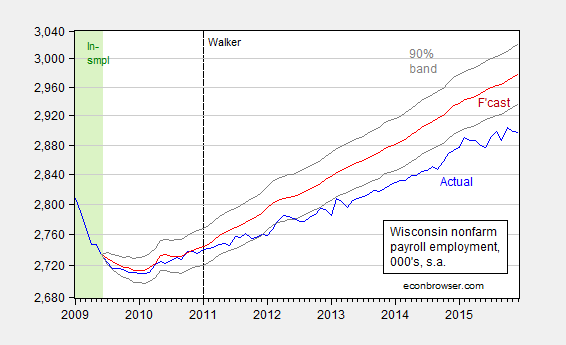

Wisconsin Governor Walker: “The state of our state is strong!”

That’s the first line of an op-ed published Monday. In other news, Wisconsin nonfarm payroll employment (NFP) and private nonfarm payroll employment is decreasing. And NFP lagging what should be the case if the historical correlation between national and Wisconsin employment held, after Governor Walker’s inauguration.

Figure 1: Wisconsin nonfarm payroll employment (blue), forecast from error correction model estimated over 1990M03-2009M06 (red), and 90% confidence band (gray lines), all on log scale. Dashed line at 2011M01 when Walker takes office, and light green denotes sample period. Source: BLS, author’s estimates (as described here).

Guest Contribution: “Asset Valuations and Recession Risks”

We are fortunate to present today a Guest Contribution written by John Kitchen (U.S. Treasury). Any views or opinions expressed are solely those of the author and not of the Treasury Department or any other institution.

With the recent declines in valuations in financial markets, an analysis based on “Relative Valuations of Fixed Capital and Financial Assets in the United States” indicates that we are in a “gray area” regarding the signaling of a heightened risk of recession.

Can lower oil prices cause a recession?

Donald Luskin writes in the Wall Street Journal:

The global economy is slipping into recession. The evidence is showing up in all the usual ways: slowing output growth, slumping purchasing-manager indexes, widening credit spreads, declining corporate earnings, falling inflation expectations, receding capital investment and rising inventories. But this is a most unusual recession– the first one ever caused by falling oil prices.

Three Random Graphs: Recession Watch, Wisconsin Employment Decline, Global Temperatures

Industrial production is down. Wisconsin nonfarm payroll employment is down. Global Temperatures hit records in 2014, 2015.

Guest Contribution: “China’s Slowdown”

Today we are fortunate to have a guest contribution written by Jeffrey Frankel, Harpel Professor of Capital Formation and Growth at Harvard University, and former Member of the Council of Economic Advisers, 1997-99. An earlier version was published by Project Syndicate.

Continue reading