…very slowly

The Wisconsin Economy since the Last Peak

Compared against Minnesota, Kansas, California, and the Nation

Potential GDP, Again

There are various ways of estimating potential output. I typically refer to the CBO’s estimates, which are basically a production function approach (use trend labor and capital stock, and total factor productivity growth, to infer potential output). However, An alternative is to examine price pressures to infer potential output, as in Ball and Mankiw (JEP, 2002).

“…inflation expectations can change quickly”

One of the arguments for acting sooner rather than later on monetary policy is that if the slack disappears, inflationary expectations will surge. That’s represented in this quote from reader Peak Trader’s comment. While I don’t rule out this possibility, it seems reasonable to me to empirically assess whether this is true for the United States over the past thirty years.

What the Taylor Rule(s) Say(s)

The St. Louis Fed has a handy webpage where it shows the Taylor-rule implied Fed funds target rate given measures of the output and inflation gaps, and the natural real rate of interest. Here’s recent snapshot I downloaded for my classes.

Preparing for lift-off

The strong October employment report makes it look likely that the era of zero interest rates will soon come to an end, at least for the United States.

Continue reading

Employment in the Recoveries

Despite the depth of the last recession, private nonfarm payroll employment is now higher than the corresponding point in the last recovery.

Today’s Employment News and Asset Prices

Just an observation regarding the impact of the employment “news” (see [CR]) and inferred expectations of a rate hike in December, and the announcement effect on the dollar’s value.

More on Governor Walker’s “Wisconsin is moving in right direction”

Updated 11/6: With Governor Walker’s comments.

Recall, that was the title of Governor Walker’s op-ed about two weeks ago. Yesterday, long time residents of Madison were made aware that Oscar Mayer will be moving out:

Oscar Mayer, which has been part of Madison’s northeast side for nearly 100 years, is closing its Madison headquarters and manufacturing plant, the company said Wednesday.

…

The Madison Oscar Mayer facility employs 1,000 people, according to Madison Mayor Paul Soglin. Kraft Heinz Company spokesman Michael Mullen said 700 of those workers are in the factory.

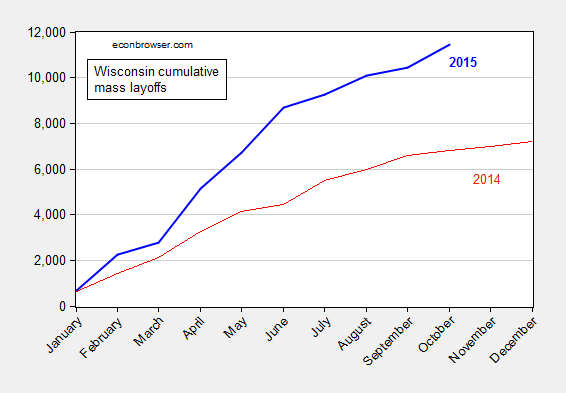

Depicted in Figure 1 are the mass layoff notification statistics as of end-October for 2014 and 2015; these do not include the Oscar Mayer statistics.

Figure 1: Wisconsin cumulative mass layoff notifications by end-month, for 2015 (bold blue) and 2014 (red). Source: DWD and author’s calculations.

Additional information on the gradient the Wisconsin economy is on presented in this post (includes a longer time series on mass layoffs, normalized by employment). For an econometric analysis of where Wisconsin economic activity should be based upon pre-Walker historical correlations, see this post (warning: you have to believe in counterfactuals to understand).

Update 11/6: From Stein and Marley, Milwaukee Journal Sentinel:

In the wake of the announced closure of the Oscar Mayer plant on Madison’s east side, Wisconsin Gov. Scott Walker said Thursday he is reaching out to corporate parent Kraft Heinz Co. but declined to spell out what his administration has done since the meat processor shed jobs here in August.

Madison Mayor Paul Soglin said he’d seen no indication the state had done anything since then to keep the plant in Wisconsin — something he found mystifying.

The GOP governor said the closing was a corporate decision that had “nothing to do with Wisconsin” and that Democratic politicians such as Soglin and Dane County Executive Joe Parisi also were caught flat-footed by the announcement.

Soglin said Madison officials met with the company after the first wave of job cuts and made clear the city would do what it could to help. The state had not done anything he was aware of, Soglin said.

“Why would they ignore a job center focused on their goals that is less than two miles from the governor’s mansion? I can’t answer that question,” Soglin said.

…

Guest Contribution: “Text of Trans-Pacific Partnership Agreement Now Online”

Today we are fortunate to have a guest contribution written by Jeffrey Frankel, Harpel Professor of Capital Formation and Growth at Harvard University, and former Member of the Council of Economic Advisers, 1997-99.

I have written a few columns (e.g. “Critics Should Keep an Open Mind,” The Guardian, Oct. 11, 2015) and posts ([1] [2]) this year supportive of TPP. Commentators on my column and critics of TPP more generally have expressed great eagerness to know when and how they could read the full legal text of the agreement. The full text is now available.

Many skeptics seem confident in their ability to understand the significance of the detailed legal language. I am less confident of that myself, not being a lawyer. There is also to be a USTR site with user-friendly text.

This post written by Jeffrey Frankel.