My estimates based on ADP, JOLTS based estimate (courtesy Paweł Skrzypczyński). Delayed CES report on 12/16 (coming out with November release).

Worse than 9/11, the Cuban Missile Crisis, and Pearl Harbor…

From The Hill:

q-theory in a Time of AI

A staple of mid-1980’s investment modeling, q-theory was an alternative to the Keynes’ marginal efficiency of capital or Jorgenson user cost of capital approaches. A version of q –the ratio of market value to replacement value of a corporation’s capital — was central in Summers’ 1981 BPEA paper modeling corporate investment behavior. And yet, q-theory is now almost completely absent from recent discussion of the level of capital investment (in contrast to the debate nearly two decades ago). Why? First a picture of q, the market price relative to replacement cost of physical capital.

An Insight into the Vibecession and Aggregate Statistics Divergence

I don’t have a resolution to the debate, but I have an insight, regarding per capita series (which is different from aggregate statistics used to determine a recession), summarized in a couple graphs.

Stablecoins As a Rorschach Test

I haven’t been following the development of stablecoins, both before and after the signing into law of the so-called “GENIUS Act”, so I found this paper a must-read: “Stablecoins: A Revolutionary Payment Technology with Financial Risks”, by Rashad Ahmed, James A. Clouse, Fabio Natalucci, Alessandro Rebucci & Geyue Sun, NBER Working Paper No 34475. [ungated version]

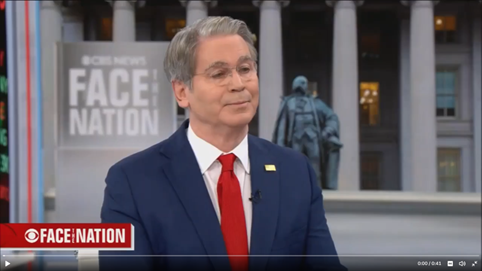

SecTrsy Bessent: “The American people don’t know how good they have it.”

Trump’s Economic Team – cont’d

Guest Contribution: “How Geopolitical Tensions Could Shape France’s Inflation Outlook”

Today, we’re pleased to present a guest contribution by Laurent Ferrara (Professor of Economics at Skema Business School, Paris and Chair of the French Business Cycle Dating Committee), and Jamel Saadaoui (Professor at University of Paris 8 – LED).

Instantaneous PCE Core Inflation at 2.6%

Compare to 2.8% y/y, 2.7% q/q AR.

Confidence Down in November, (preliminary) Sentiment (Slightly) Up in December

U.Mich on December, Gallup on November: