Today, we’re pleased to present a guest contribution written by Catherine Doz (Paris School of Economics), Laurent Ferrara (SKEMA Business School and International Institute of Forecasters) and Pierre-Alain Pionnier. The views presented represent those of the authors, and not necessarily those of the institutions the authors are affilliated with.

First Virtual IIF Workshop on “Economic Forecasting in Times of Covid-19”

Call For Papers

July 6-7, 2020

The COVID-19 pandemic has triggered a massive spike in concerns and uncertainties and raised challenges in macroeconomic forecasting surrounding almost every aspect. The purpose of this virtual workshop is to bring together researchers working on various aspects of measurement, modelling, evaluation and forecasting of COVID and its impact on the economy.

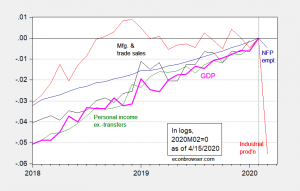

Some Business Cycle Indicators, April 15th

Here are some key indicators followed by the NBER’s BCDC as of today:

Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2019M01=0. Manufacturing and trade sales for February assumed to be at stochastic trend for 2018-2020M01. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (3/26 release), and author’s calculations.

Guest Contribution: “Will the Recovery be J-Shaped?”

Today, we are pleased to present a guest contribution written by David Papell and Ruxandra Prodan, both of the Department of Economics at the University of Houston.

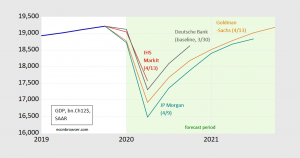

Some Forecasts

It’s been interesting to me to see how various economic groups assess the outlook. Here are a select few:

While rapid growth is projected for the end of the year, it’s of interest to note that output will still be below the pre-Covid19 trajectory.

It must be an unenviable task to forecast output in these times. Thinking about it a bit, on top of the usual challenges, these forecasts have to be conditioned on big question marks (so known unknowns as well and unknown unknowns).

- Scientific unknowns about degree of contagiousness, whether there’s seasonality, the ease of reinfection

- Political unknowns such as commitment to developing an infrastructure to test, track the epidemic, so that the economy can be restarted without large increments to fatalities.

- Unknowns regarding how the health infrastructure has been degraded by the scattershot administrative response, thereby constraining the readiness for restart

- Unknowns regarding administrative capacity of a Federal government that has many policy level positions still vacant.

Update, 4/21:

A Vox article on the difficulties of forecasting, even w/o a pandemic, here.

The Council to Re-Open the Economy

Three Waves of the 1918-20 Flu: UK

The 20181918-20 pandemic waxed and waned. This suggests there is not necessarily a quick return to “normalcy”.

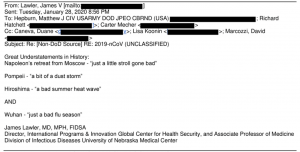

Who Knew What, When?

“Red Dawn” emails documenting how everybody who was knowledgeable about pandemic threats knew by 1/28, even as Trump kept on comparing the novel coronavirus to the flu up to March 9th – example:

Email from Dr. James Lawler, professor, and doctor who served in the WH under Pres. G.W. Bush, & adviser to Pres. Barack Obama. More emails, see here, article here.

I still wait to find out when the President’s Daily Brief on the coronavirus threat was circulated.

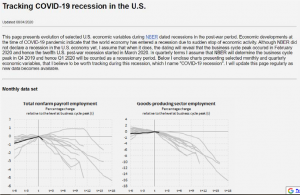

Tracking the Current Recession

Paweł Skrzypczyński has taken on the task of tracking what he calls the Covid-19 recession as the data come out:

And Here It Comes: There’s an early January PDB on the Novel Coronavirus

From ABC News today:

“Analysts concluded [a novel coronavirus pandemic] could be a cataclysmic event,” one of the sources said of the NCMI’s report. “It was then briefed multiple times to” the Defense Intelligence Agency, the Pentagon’s Joint Staff and the White House.

From that warning in November, the sources described repeated briefings through December for policy-makers and decision-makers across the federal government as well as the National Security Council at the White House. All of that culminated with a detailed explanation of the problem that appeared in the President’s Daily Brief of intelligence matters in early January, the sources said. For something to have appeared in the PDB, it would have had to go through weeks of vetting and analysis…

We need the PDB declassified and released, to understand the full magnitude of the public policy disaster this administration has visited upon America, just like this PDB of August 6, 2001 “Bin Laden determined to strike in US” was released.