No major economics agency or group has forecasted a recession in their baseline. However, forecasts are definitely being marked down.

When Ideologues Talk Macro

From Mr. Riedl at Manhattan Institute:

I really hope the fiscal stimulus debate doesn’t gain momentum. Not only is it premature…..but I don’t have the writing bandwidth to remind everyone how Keynesian stimulus is an outdated theory (the multiplier is close to zero) with a terrible historical track record.

Forward Looking Components of Economic Activity

Nonresidential fixed investment has been declining for three quarters, while equipment has been declining for two quarters. If Atlanta Fed nowcasts prove right for the current quarter, then as of 2020Q1, equipment investment will have fallen for three quarters (while nonresidential will still be below peak).

Business Cycle Indicators as of 3/1/2020

Business cycle indicators that NBER examines (along with others):

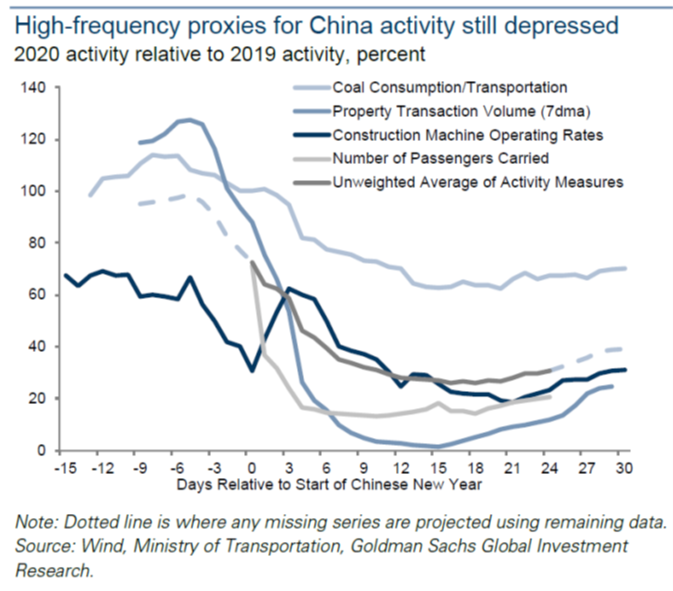

High Frequency Economic Indicators for China

Guest Contribution: “The predictive power of equilibrium exchange rates”

Today we are fortunate to present a guest post written by Michele Ca’ Zorzi (ECB), Adam Cap (BIS), Andrej Mijakovic (European University Institute) and Michal Rubaszek (SGH Warsaw School of Economics). The views expressed in this paper are those of the authors and not necessarily those of the institutions they are affiliated with.

Guest Contribution: “Will the Coronavirus Lead to Global Recession?”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate February 24th.

Trend Deviation in Freight Transportation

Freight movement as measured by the BTS Freight Transportation Services index is down, relative to trend.

Recession Probability for Term Spread thru 2/24

If the last few days of February is like the rest, then recession probabilities are up. Using a plain-vanilla probit model of recession based on the10yr-3mo spread, the following recession probabilities are obtained.

10yr-3mo Treasury Spread and TIPS 10yr

Figure 1 shows both of these at monthly frequency, with February data through 2/21.