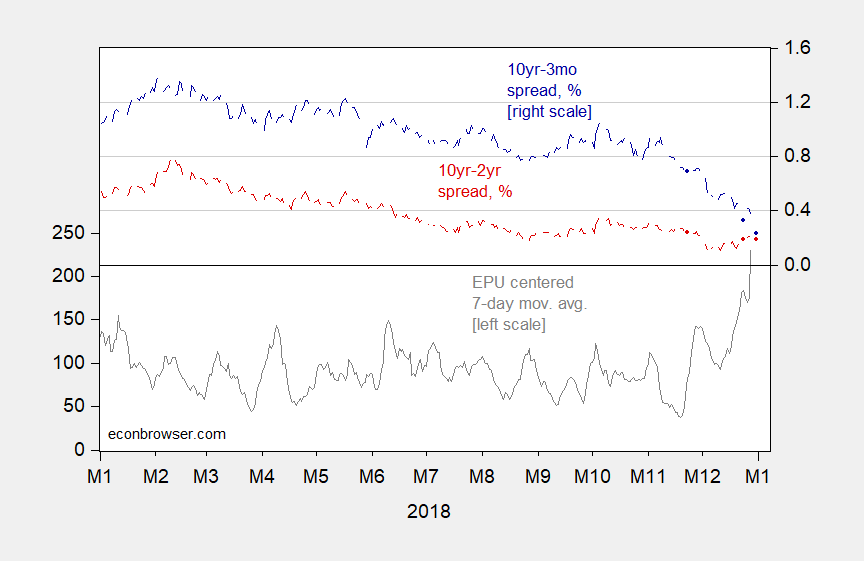

Figure 1: Baker Bloom and Davis Economic Policy Uncertainty index, centered 7 day moving average (gray, left scale), and ten year – three month Treasury spread, % (blue, right scale) and ten year – two year spread, % (red, right scale). Source: policyuncertainty.com, FRED and author’s calculations.