One interesting correlation, as pointed out by Clines in the NYT, is between the Mexican peso’s value against the USD and the probability that Donald J. Trump will win, as judged by the markets.

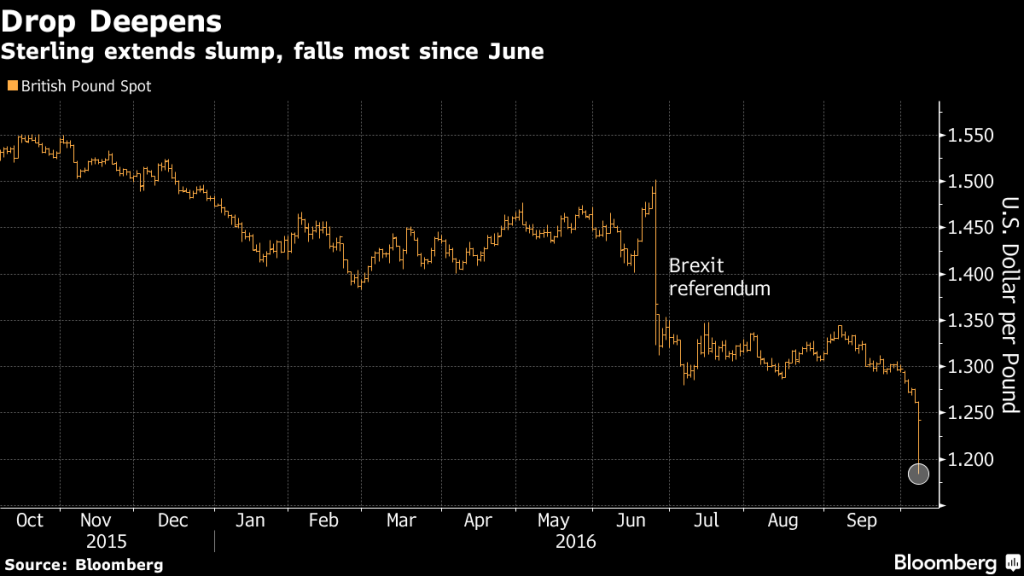

No Kidding: “Hard Brexit has haunted the sterling.”

Ron Alquist brings my attention to this ongoing story:

Source: Bloomberg 10/6/2016.

IMF World Economic Outlook, October 2016

Today, the IMF released forecasts of substantially downwardly revised growth estimates for the US. UK 2017 growth revised down 1.1 percentage points relative to pre-Brexit forecast (World Economic Outlook).

OPEC production cut

The Wall Street Journal reported on Thursday:

OPEC said its members agreed that they need to cut crude output to reduce the world’s supply glut, a shift for the 14-member group that was enough to send oil prices higher, even though reaching a deal remains far from certain.

Members of the Organization of the Petroleum Exporting Countries said they reached an understanding after a six-hour gathering in the Algerian capital, but deferred until November the fraught task of finalizing a plan to make those cuts. OPEC officials said a committee would be formed to determine how much each country would have to cut and then report to the group at its next meeting on Nov. 30 in Vienna.

On Reading the Trump Economic Plan

At the beginning of the week (9/27), Bruce Bartlett forwarded me a link to a remarkable document, entitled “Scoring the Trump Economic Plan: Trade, Regulatory, & Energy Policy Impacts” (strangely, dated 9/29), coauthored by Peter Navarro* and Wilbur Ross. I’m way behind the curve, and there have been numerous examinations of the document, so I will not discuss the entire paper. Rather I’ll focus on the following specific question: would renegotiating trade agreements and slapping tariffs on China, conjoined with the Trump fiscal policy, induce a drastic change employment and trade flows? The short answer — yes, but probably in a direction opposite of that posited by the authors.

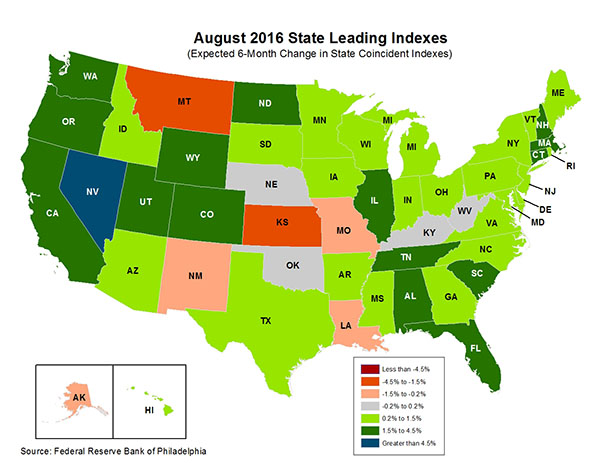

Confirmed: Kansas as Leader of the Pack

The Philadelphia Fed today released leading indices for the 50 states and the US. Kansas records the largest projected six-month decline in activity (after recording the largest in the Nation three month decline through August).

Source: Philadelphia Fed leading index page.

Continue reading

US Employment Implications of Preferential Trade Arrangements

In the debate on Monday, Donald J. Trump comments on Nafta’s impact:

You go to New England. You go to Ohio, Pennsylvania. You go anywhere you want, Secretary Clinton, and you will see devastation where manufacturing is down thirty, forty, sometimes fifty percent — NAFTA is the worst trade deal maybe ever signed anywhere but certainly ever signed in this country.

Donald J. Trump on Fed Policy

From the Monday debate:

Guest Contribution: “A Radical Solution to the Fundamental Flaws in US Politics: Vote!”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

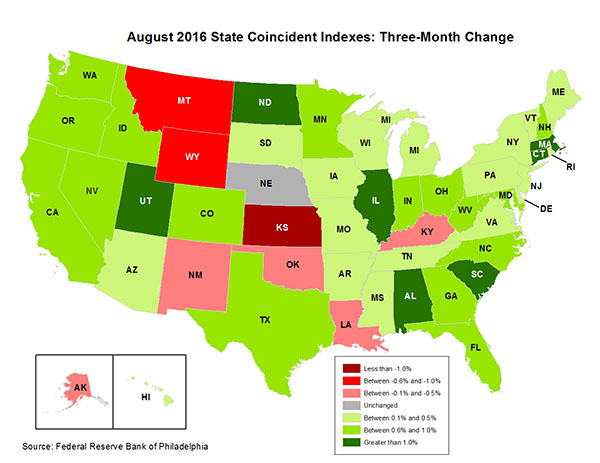

Kansas Drought Free – Economic Activity Declines

No more drought in Kansas. And yet, according to the Philadelphia Fed, Kansas again stands out in economic decline:

Source: Philadelphia Fed.