Earlier on, Moody’s Analytics took on the task of determining the likely impact of implementing the Trump economic pronouncements (tax cuts for the wealthy, massive deficit spending, increased defense spending, spending cuts on other discretionary components, and revocation of free trade agreements). Oxford Economics has taken up the task of evaluating the more recent incarnations of his pronouncements (to call it a “plan” is giving it too much credence).

Still Lovin’ Debt

Instead of zooming to 130% debt-to-GDP ratio, the new Trump plan only takes it up to 105%.

Continue reading

The Kansas Malaise: Drought or Government Output as Culprit?

Or, the continuing investigation of how drought does not explain the Kansas economic debacle, using conventional econometric techniques.

The Dollar, Tradables, and Monetary Policy

One argument for tightening monetary policy is derived from the argument the Fed needs to raise rates to close a “confidence gap”. Instead of psycho-analyzing the markets, I think it better to focus on data.

Why didn’t the recent oil price decline help the U.S. economy more?

Christiane Baumeister and Lutz Kilian presented an interesting paper at the Brookings Institution last week that takes a detailed look at the effects on the U.S. economy of the dramatic oil price decline of 2014-2015.

Continue reading

August Employment in Kansas: First Read

Updated 9/20 to reflect BLS state level employment data

The Kansas Department of Labor released some limited numbers regarding August labor market conditions today. These figures are consistent with an economic stall indicated in the Philadelphia Fed projections, discussed in this post.

Term Spreads Today

A couple months ago, we were worrying about a yield curve inversion signalling recession. Now there are anxieties about surging long yields, as — apparently — inflation fears loom. It seems to me a little perspective is necessary.

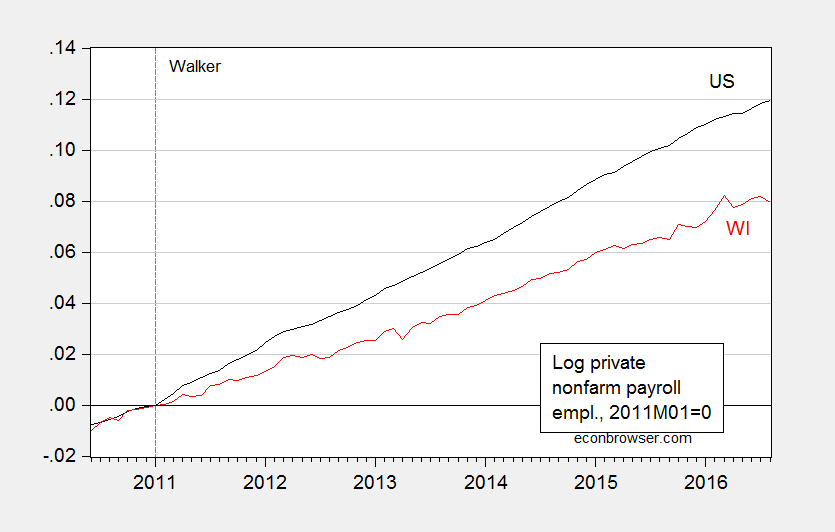

Wisconsin Employment in August

Wisconsin DWD release here.

Here’s private nonfarm payroll employment relative to 2011M01.

Figure 1: Log private nonfarm payroll employment for US (black) and WI (red), seasonally adjusted, both normalized to 2011M01=0. Source: BLS, DWD, and author’s calculations.

Kansas to Lead the Nation…Downward

The Philadelphia Fed’s indices indicate economic contraction in June and July. Leading indices indicate further contraction, by a percentage larger than any other state.

“Exchange Rate Prediction Redux: New Models, New Data, New Currencies”

That’s the title of a new paper, coauthored with Yin-Wong Cheung, Antonio Garcia Pascual, and Yi Zhang.