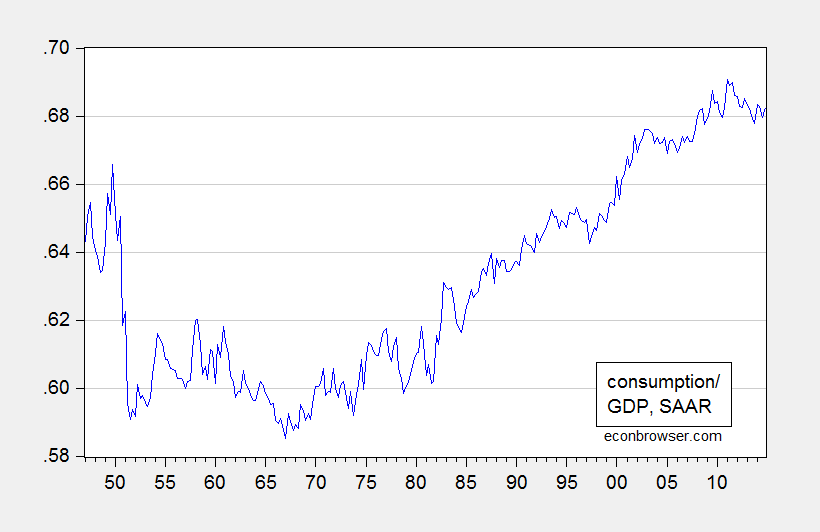

Commenting on the Kansas Palmer Drought Severity Index, Rick Stryker writes: “From a theoretical point of view it must be stationary.” He reasons that this is so, because it is bounded between -10 and +10. Question: Is this a relevant piece of information when examining finite samples? Let’s look at consumption as a share of GDP, which must be bounded between 0 and 1.

Figure 1: Nominal consumption to GDP ratio, SAAR (blue). Source: BEA, author’s calculations.