Today we are fortunate to have a guest contribution by Helen Popper, professor of economics at Santa Clara University.

Evaluating the Chinese Devaluation

The 2% devaluation of the Chinese yuan on Monday, and subsequent 1.6% weakening on Tuesday, was variously described as surprising and stunning. I think it was to be expected, given China’s slowing growth, although there was no particular reason to believe Monday would be the day. In evaluating the effects, one has to first place the drop in context.

Guest Contribution: “Gas Taxes and Oil Subsidies: Time for Reform”

Today we are fortunate to have a guest contribution written by Jeffrey Frankel, Harpel Professor of Capital Formation and Growth at Harvard University, and former Member of the Council of Economic Advisers, 1997-99. A shorter version was published at Project Syndicate.

Kansas: The Macro Outlook

The politics of the The Kansas Experiment were recounted in Sunday’s NYT Magazine. Does the economic crash continue?

OPEC and world oil supplies

There’s been a remarkable surge in world oil production over the last year. And the United States is only part of the story.

Continue reading

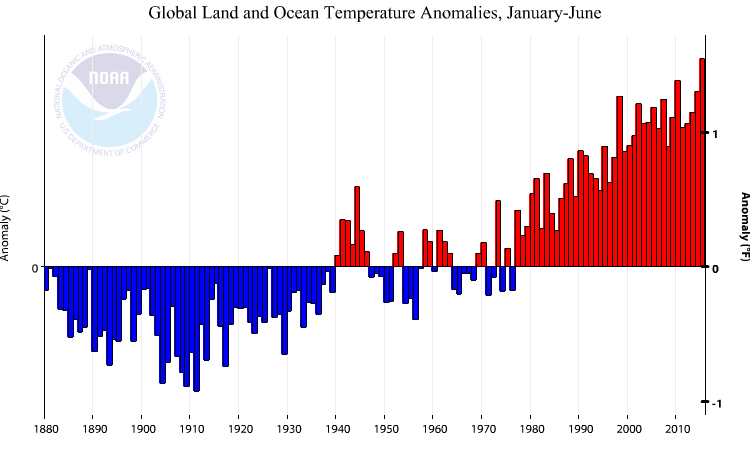

“Global warming is a total, and very expensive, hoax!”

Source: Donald J. Trump, 6 December 2013.

Here’s some data: Global surface anomaly, year-to-date (June):

Source: NOAA

National Employment Powers Along

While Wisconsin lags, and statistically significantly so…

To Log or Not to Log, Part III

Has nonresidential fixed investment risen faster than GDP since the dot.com peak?

To Log or Not to Log, Part II

Following up on this post, estimating the consumption function

To Log or Not to Log, Part I

Reader Mike V castigates me for over-use of logs.

I’m not at all averse to logs, but they have a time an a place. You are trying to point out relatively small changes in income over a short time-series – not the nearly exponential changes in the S&P 500 over the last 100+ years.