The politics of the The Kansas Experiment were recounted in Sunday’s NYT Magazine. Does the economic crash continue?

OPEC and world oil supplies

There’s been a remarkable surge in world oil production over the last year. And the United States is only part of the story.

Continue reading

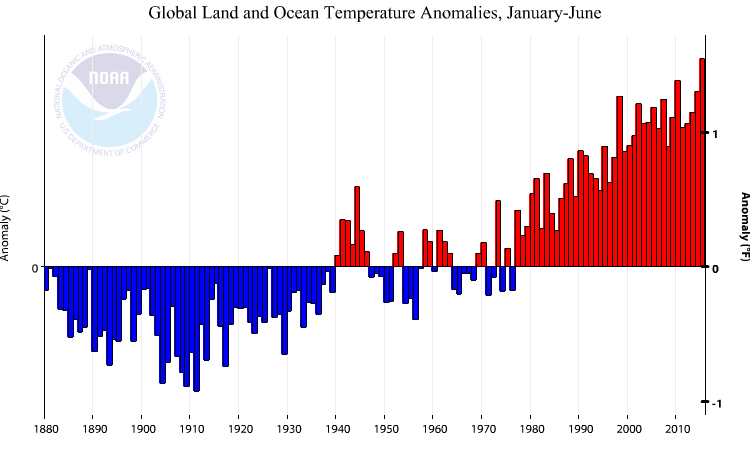

“Global warming is a total, and very expensive, hoax!”

Source: Donald J. Trump, 6 December 2013.

Here’s some data: Global surface anomaly, year-to-date (June):

Source: NOAA

National Employment Powers Along

While Wisconsin lags, and statistically significantly so…

To Log or Not to Log, Part III

Has nonresidential fixed investment risen faster than GDP since the dot.com peak?

To Log or Not to Log, Part II

Following up on this post, estimating the consumption function

To Log or Not to Log, Part I

Reader Mike V castigates me for over-use of logs.

I’m not at all averse to logs, but they have a time an a place. You are trying to point out relatively small changes in income over a short time-series – not the nearly exponential changes in the S&P 500 over the last 100+ years.

Guest Contribution: “Were Chinese regulators responsible for the recent stock market bubble?”

Today we are fortunate to have a guest contribution written by Jeffrey Frankel, Harpel Professor of Capital Formation and Growth at Harvard University, and former Member of the Council of Economic Advisers, 1997-99.

Recovery without Military Keynesianism

Thursday’s GDP release incorporated an annual data revision extending back to 2012. In this recovery, output is 4% lower (in log terms) than the corresponding point in the previous recovery. In Ch.2009$, 2015Q2 output was 92.9 billion lower (at quarterly rates). The comparison (in log levels, normalized to troughs) is shown in Figure 1.

Guest Contribution: “Should Emerging Markets Fear A Fed Lift-Off?”

Today we are fortunate to have a guest contribution written by Carolina Osorio Buitron, Esteban Vesperoni, and Prakash Loungani, from the Research Department of the International Monetary Fund. The views expressed in this blog are solely those of the authors and do not necessarily represent the views of the IMF, its management, nor its Executive Board.