Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. This column is based on “The Next Economic Crisis,” remarks on a panel at the 2nd annual retreat of the American Enterprise Institute in Jackson Hole, Wyoming, August 13. A shorter version appeared in Project Syndicate.

Category Archives: recession

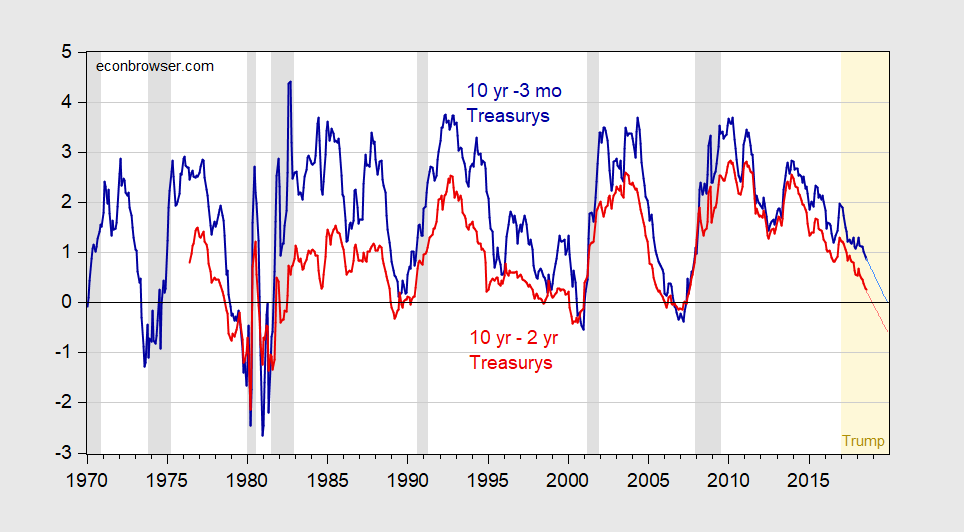

At the Current Pace, the 2-10 Will Invert in December

Holding to the Old Faith

Figure 1: Ten year-3 month Treasury yield spread (bold dark blue), and ten year-two year Treasury yield spread (bold dark red), and projections at current pace using 2017M01-18M08 sample (light blue and pink lines), in percentage points. August 2018 observation through August 27th. NBER defined recession dates shaded gray. Light orange denotes Trump administration. Source: Federal Reserve Board via FRED, Bloomberg, NBER, author’s calculations.

Continue reading

The Term Spread and Dollar Diverge

With the election, and anticipation of a large fiscal impulse (tax cut, infrastructure spending), the dollar rose and the term spread increased. As expectations of the latter disippated, both the dollar and spread shrank. But recently, the comovement has broken down.

A Short Macrohistory of Kansas

Following up on Chinn-LeCloux (2018), here are five aggregates for the Kansas economy.

A Short History of Turning Points in Wisconsin

Ever since the Walker Administration ended the issuance of the Wisconsin Economic Outlook (last issue May 2015), those of us outside of the government have been a little in the dark when trying to assess state level economic conditions in a systematic manner. In a recent paper (updated version 8/1), Ryan LeCloux and I assess how various macroeconomic aggregates track the Wisconsin economy at higher-than-annual frequency. Investigating the behavior of these series yields the following graph.

A Great Second Quarter Report — But Beware the Context

Following up on Jim’s post on the GDP release, here are four observations.

Continue reading

Not Quite Twin Peaks

Nominal asset prices, including S&P500 and home, continue to rise, but real prices have not regained prior levels (S&P500) or have plateaued (home prices).

Thinking about Macro Data and Revisions and Recessions: A Cautionary Tale

Indications are that a week from tomorrow, we will receive a very strong report on GDP growth (Jim will have his recession probabilities assessment soon after the release). (GS at 4.1%, MacroAdv at 5.0%, NY Fed at 2.8%, FRB Atlanta NowGDP at 4.5%.) At the same time, we are seeing a flattening of the yield curve. I urge observers to not take as “hard data” the advance release of any macro data as firm. Here is a cautionary tale.

Term Spreads as of Noon Today

Trending down.

Continue reading

The Trade Policy Annotated Yield Curve

Down, down, down. 10yr-3mo at 0.86% at 2pm today. See Jim’s post for more on the spread.

Continue reading