Donald Trump’s pronouncements can typically be taken as contra-indicators. In other words, what he says is invariably wrong. So, you gotta wonder on China…

Continue reading

Category Archives: Trade Policy

SitRep from the Midwest

No end to “the blip“. From today’s Des Moines Register:

The Never-Ending Blip

On July 9, 2018, almost exactly a year ago, reader CoRev wrote:

Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

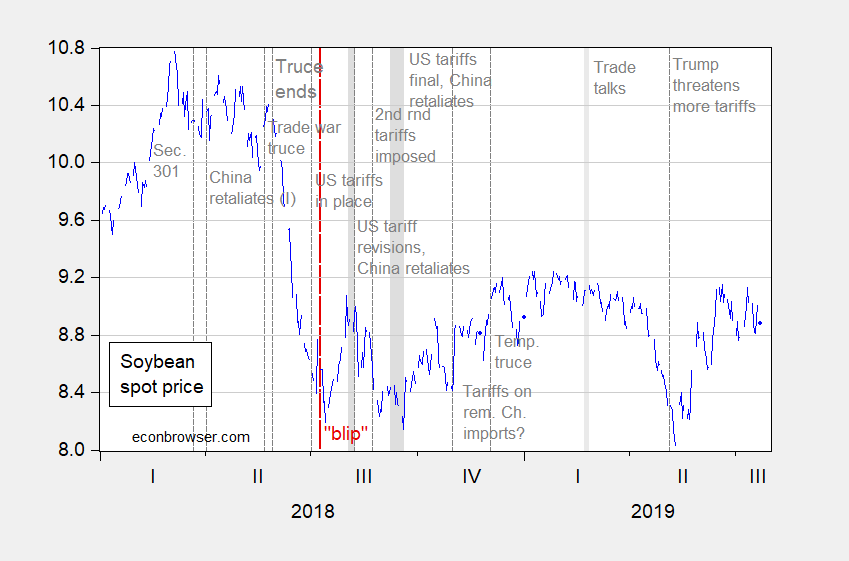

Prospects for a Resolution to the US-Trade Dispute Inferred from Soybean Futures

Asset price movements around “news” regarding policy can illuminate the market’s assessment of the outlook for trade policy. Looking at a small window (say half hour) around an event can allow one to separate other factors (weather, other demand factors) from other. With that, let’s look at soybean futures (September 2019)…

The Answer Is No (and No)

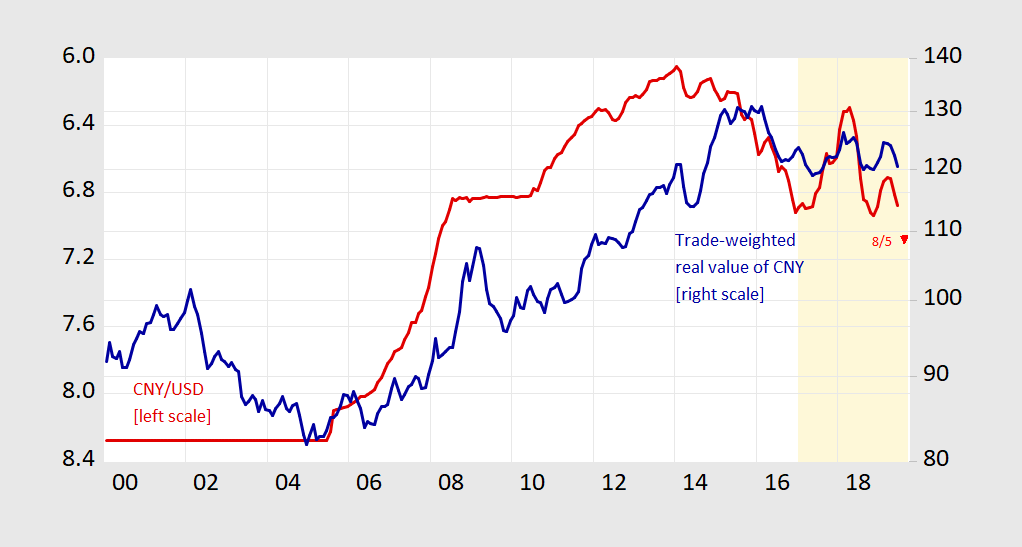

Figure 1: CNY/USD nominal exchange rate (red, left inverted scale), 8/5 value (red triangle, left inverted scale), trade weighted real value of CNY against broad basket of currencies (blue, right log scale). Up denotes appreciation. Light orange shading denotes Trump administration. Source: FRED, and BIS.

In a new (and extremely timely) EconoFact memo on Should the United States Try to Weaken the Dollar?, Michael Klein and Maury Obstfeld ask:

The 16 Month-long Blip in Soybean Prices

On July 9, 2018, reader CoRev disparaged futures prices as accurate predictors of future spot prices for soybeans, writing:

no one has denied the impact of tariffs on FUTURES prices. Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

A Business-Cycle Mystery: Manslaughter or Murder?

If recoveries don’t die of old-age, then they either have “accidents” or they’re murdered. I’m not sure what a business-cycle accident is, but we can check what might have killed the recovery, should we enter a recession in 2020, as suggested by some forward looking financial indicators. I’ll look at investment spending, a forward looking variable, highly sensitive to interest rates, and the outlook for economic activity and uncertainty.

Equipment Investment, Capital Goods Imports, and the Impending Slowdown…Again

Equipment investment is flat; capital goods imports (aside from aircraft and computers) declining 4% per annum.

“Across-the-Board Tariffs on China with Retaliation and Federal Spending Create Over 1 Million Jobs in Five Years”

The Coalition for a Prosperous America publishes another study imbued with “secret sauce” structure…From the “working paper” (more akin to a press release):

Specifically, we introduce the effects of Chinese retaliation with tariffs on US exports to China; we add the effects of the US Department of Agriculture’s (USDA) programs to support farmers and food processors negatively affected by Chinese retaliation; and, we add the impact of the US government spending the revenue generated by the China tariffs. We find that Chinese retaliation reduces the benefit to the US economy by 14 percent, but the net benefit remains large. The USDA programs provide relief to the agricultural industry and restore the net benefit to almost the same level as before the retaliation. Finally, we look at the impact of the government reinvesting the tariff revenue in the US economy by boosting government spending…

A Year-Long Blip

Figure 1: Soybean spot prices. Source: Macrotrends.com, accessed 7/23/2019.

Back on July 9th of last year, an Econbrowser reader wrote:

Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

Needless to say, prices are not back to where they were in Sept-Nov 2017. Instead, Brazil has siezed market share and US soybean shipments to China have plummeted. From USDA FAS “Oilseeds”, on July 11th: