Interesting to note that the dollar has declined in tandem with economic policy uncertainty, as measured by the Baker, Bloom & Davis index (and predicted by historical correlations).

Improving Economic Prospects

As measured by the February WSJ survey. Even then, mean forecast GDP — presumably conditioned on additional government spending and tax cuts — does not hit potential GDP until beginning of 2022.

Do Not Add Chain Weighted Quantities, Illustrated

I’ve discussed in an earlier post the fact that the sum of chain weighted quantities does not usually sum to the corresponding total chain weighted quantity. Here is a more recent example, that demonstrates the dramatic shifts in relative prices of consumption types.

Some Economic and Statistical Terms (Mis)Used in This Blog’s Comments Section

These are all terms that have been misused in comments on this blog (all by one person!). For purposes of facilitating coherent discussion, I provide some short definitions.

Bram, Karahan & Moore: “Minimum Wage Impacts along the New York-Pennsylvania Border”

From conclusion to the Liberty Street post:

In gauging the effects of New York’s escalating minimum wage on two sizable low-wage industry sectors, one growing and the other shrinking, we find that it appears to have had a positive effect on average wages but no discernible effect on employment. It is possible that there was some negative effect on weekly hours worked, though that would imply an even stronger upward effect on hourly wages. However, longer-term effects, if any, remain to be seen. It is certainly conceivable that minimum-wage differentials may affect decisions on firm location, business investment, lease renewal, and the like over a longer time horizon. Moreover, as currently scheduled, the phasing in of the higher minimum wage across upstate New York still has a long way to go. Thus, we will continue to monitor local trends in both employment and wages—particularly in these lower-wage sectors.

Guest Contribution: “Remembering George Schultz & a 1983 Reagan cabinet meeting”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared at Jeff Frankel’s Blog.

Musings on: “What the he** do you teach your students, Menzie”

Steven Kopits argues about the relevance of market imperfections, to wit:

What the hell do you teach your students, Menzie? “Well, you know, here’s the theory, but let’s not get carried away with it in real life.”? Why would anyone want to be an economist when the bulk of your views seem to revolve around exceptions to the rule, about presumptions that you are smarter than the market or that markets don’t work?

The Effect of Proposed Minimum Wage Legislation

Here’s a time series of the real minimum wage, under the Sanders proposal.

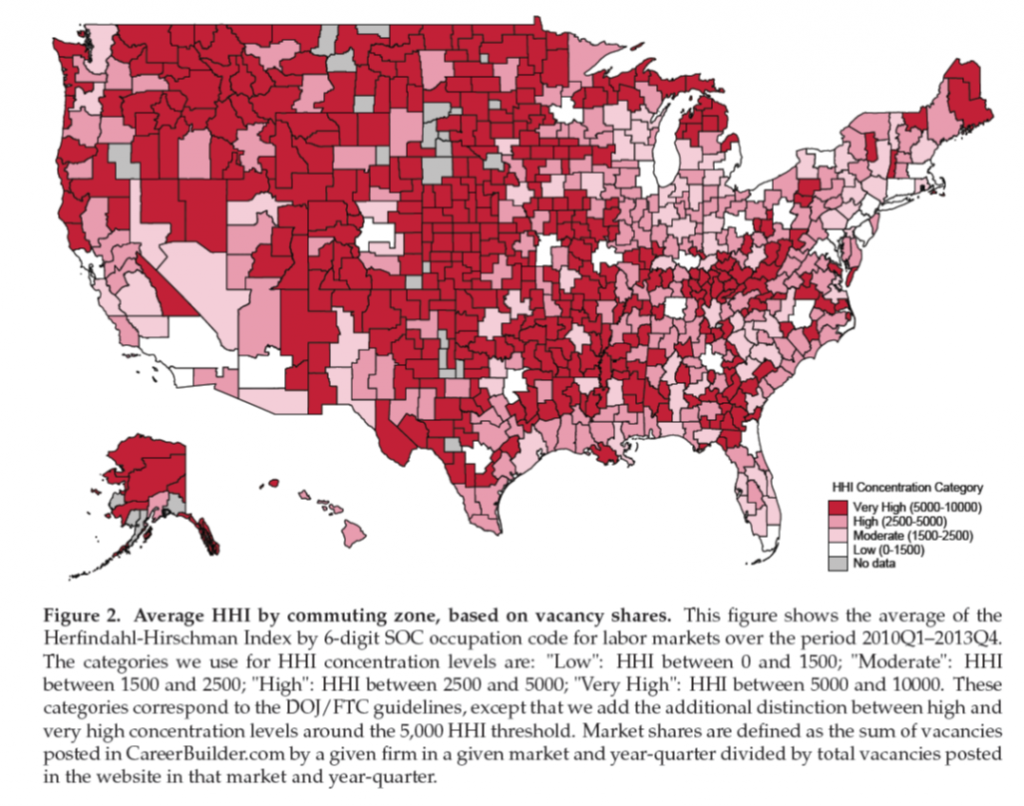

Labor Market Monopsony Estimated

Azar, Marinescu, Steinbaum (2018) as SSRN [NBER WP version] [preprint at J.Human Resource]:

Addendum, 2/8 8am Pacific:

And here is a very recent survey of labor market monopsony: Manning, ILR (2021).

Guest Contribution: “What the GameStop Bubble Says about Financial Markets”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared at Project Syndicate.