With the release of personal income and sales figures today, we see the continued deceleration in economic activity continues, according to some key indicators noted by the NBER’s Business Cycle Dating Committee (BCDC).

Guest Contribution: “Biden’s Better on Economics”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A longer version appeared at Project Syndicate and the Guardian.

Record-breaking increase in GDP

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 33.1% annual rate in the third quarter. That’s the largest change ever recorded, even bigger than the -31.4% annual rate now reported for 2020:Q2. What do those numbers tell us?

Continue reading

(Non)Diversity in Econoblogging

The issue of diversity in economic discourse has occupied a prominent place over the past few years. The AEA has had long running initiatives to broaden the diversity of individuals in the economics professions, along gender, racial and ethnic lines, but it’s fair to say they have become much more visible as the debate has waxed: https://www.aeaweb.org/resources/best-practices . The last AEA conference had a panel devoted to the topic of racial diversity (video) . A good summary of the argument for promoting diversity in the economics profession is provided by Janet Yellen. A forceful statement on the economics professions gender diversity problem is here.

What about the EconoBlogosphere (or what remains of it)?

What Are Current Borrowing Costs for the Federal Government?

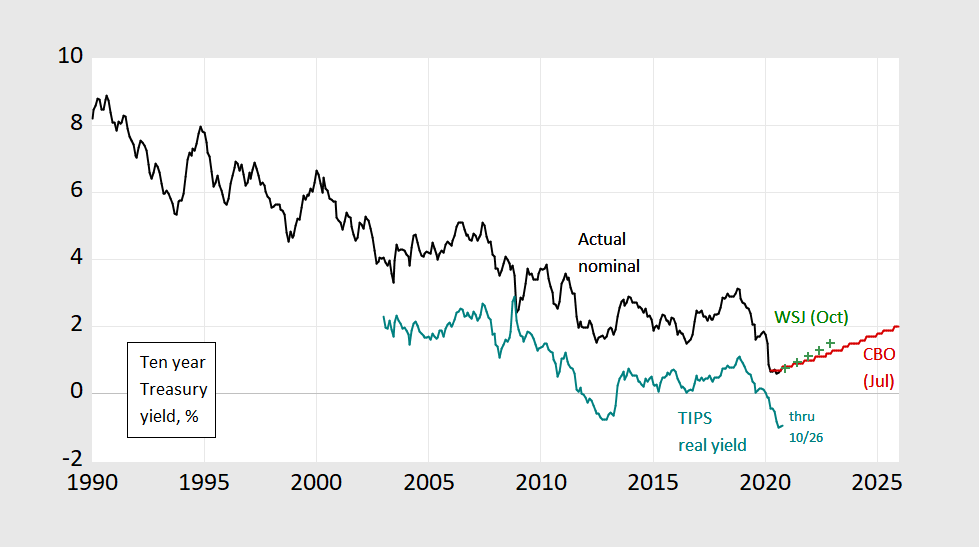

Remember Δbt = (r-g)bt-1 + deft , where b is debt/GDP, r is the real interest rate, g is the GDP growth rate, and def is the primary budget deficit/GDP ratio. What’s r?

Figure 1: Ten year constant maturity Treasury yield (black), WSJ October survey mean forecast (green +), CBO July projection (red), and ten year TIPS (teal), all in %. October 2020 is data through 10/26. Source: Federal Reserve via FRED, WSJ, and CBO.

Guest Contribution: “The Relative Performance of the U.S. Federal Debt”

Today we are fortunate to have a guest contribution by Sam Williamson, Emeritus Professor of Economics at Miami University, and President of Measuring Worth. This is the second post in a series; the first post is here.

Guest Contribution: “The Relative Economic Performance of the Trump Administration”

Today we are fortunate to have a guest contribution by Sam Williamson, Emeritus Professor of Economics at Miami University, and President of Measuring Worth.

Yet More Economists against Trump

In addition to previous open letters, here is one released today, with over 750 signatories:

Labor Force Developments

Nationwide, labor force down 2.7% from February, and down 2.4% from year ago.

Alan Blinder on the Biden Agenda

The Center for Research on the Wisconsin Economy (CROWE) sponsored a series of talks on the election and economic issues. Yesterday’s talk was by Princeton’s Alan Blinder (former CEA member, former Fed Vice Chair). His talk with Q&A is here (YouTube).

Other visitors included Lee Ohanian, Diane Whitmore Schanzenbach, Casey Mulligan and Brian Riedl (Manhattan Institute).