In levels (incorporating revisions to actual GDP):

Deal/No Deal

Macro (GDP) implications of “no deal”.

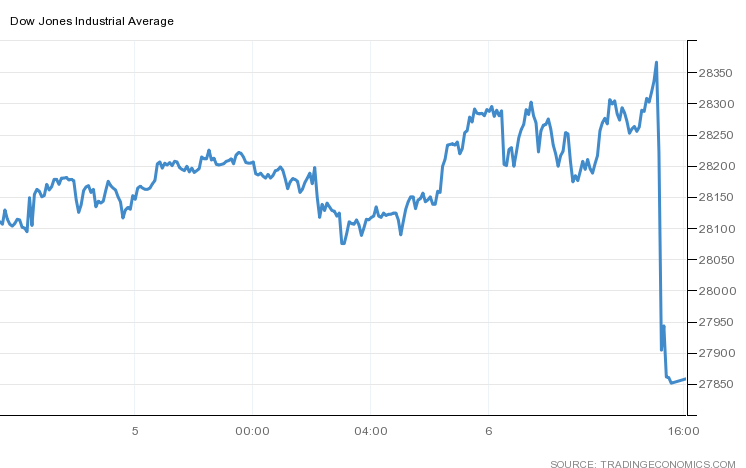

Wall Street Votes on Ending Covid Package Negotiations

The Hill (posted at 3:01 EDT):

President Trump said Tuesday that he has instructed his top aides to stop negotiating with House Speaker Nancy Pelosi (D-Calif.) on future coronavirus stimulus legislation until after the November election.

The Dow Jones:

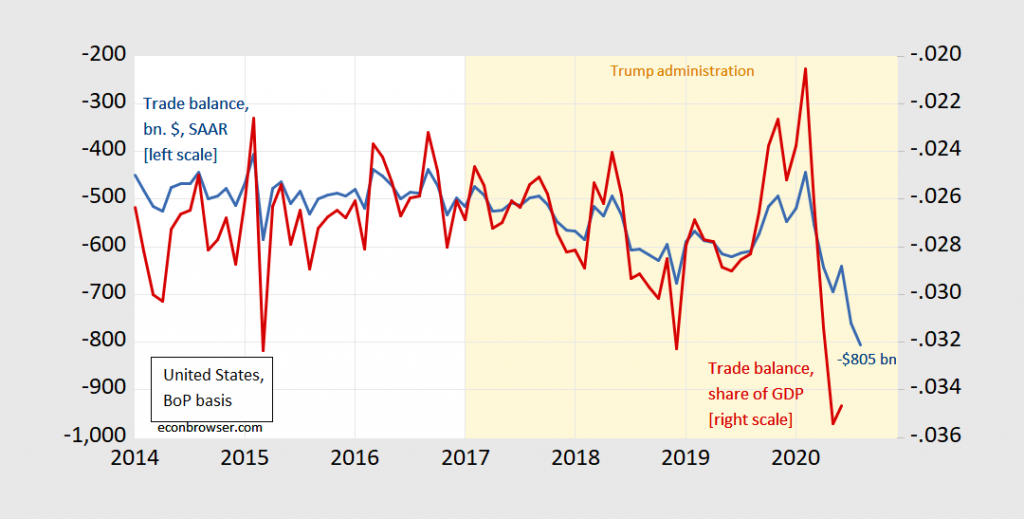

Still More Winning! “U.S. goods trade deficit in August hits record high”

Headline from Politico. From today’s trade release for August:

Figure 1: US trade balance, bn. $, SAAR (blue, left scale), as a share of GDP (red, right scale). Light orange shading denotes Trump administration. Nominal GDP interpolated quadratic match. Source: BuCensus/BEA via FRED, BEA, and author’s calculations.

Economists for Biden-Harris

More than 200 economists have signed a letter of support for Joe Biden and KamalaHarris. Signers include Nobel Prize winner Joseph Stiglitz, Laura Tyson,William Spriggs, Claudia Goldin, Robert Reich, Robert Gordon, Ebonya Washington, Jeff Sachs, and Emmanuel Saez. The letter contends that the U.S. is facing a series of simultaneous major crises — health, economic, and political — and that only strong national leadership from the Biden-Harris ticket supported by a grassroots democratic movement can address these crises and create an economy that works for all Americans.

Synergy in Wisconsin

College re-opening or disdain for masks…or both! From WSJ:

Some public-health officials say they suspect that the large number of socially inclined students returning to the state at the end of August and start of September worked in tandem with another dynamic: a large number of state residents who don’t wear masks, they say, because many communities don’t require them or don’t enforce orders requiring them.

Guest Contribution: “Will the Coronavirus Spur Action on Climate Change?”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate and The Guardian.

A Funny Forecasting Story

Last night, I knew I was on tap to talk about Wisconsin GDP numbers today (Wisconsin Public Radio report here). I wondered what a naive forecast would imply, so I regressed first difference of log Wisconsin GDP on first difference of log US GDP and a lagged Wisconsin GDP first difference, to obtain this forecast…(red square)

Swing State Wisconsin: A LaFollette/WisPolitics Panel

A Panel presented by UW–Madison’s La Follette School of Public Affairs and WisPolitics.com (October 2), video here.

Wisconsin Q2 GDP

Wisconsin GDP declined by 32.6% (SAAR) in 2020Q2, compared to 31.4% for the US. BEA’s release today notes Wisconsin’s Q/Q growth in Q2 ranked 35th.