Covid-19 related current hospitalizations are up; administratively defined fatalities are up slightly. However the pattern displayed in figure 1 is unsettling (a rejoinder to all those folks who think hospitalization is falling, and think cases rising is merely a reflection of more testing; e.g., here).

Nowcasts Compared

NY Fed, Atlanta Fed, St. Louis Fed, and IHS Markit released nowcasts today.

Covid-19: Excess Fatalities vs. Administrative Counts

In contrast to earlier weeks, the most recent “excess fatality” count is solidly in the positive region, despite the severe under-reporting bias in the most recent observations. To see this, consider the most recent estimates for each of the previous vintages of “excess fatalities” calculated as actual-expected.

This Time Was Not Different

Revising notes on recession prediction for my course, I find the 10yr-3mo spread has preceded 7 of the last 8 recessions (8 if the 14 bps near inversion of mid-1989). And back in June 2019, recession seemed not unlikely.

Wisconsin Alumni Assn/La Follette School/Elections Research Center panel: “Foreign Relations, Trade, & Policy: 2021 and Beyond”

On Oct 12, 7-8:30pm Central:

Moderator: Susan Webb Yackee — director of the La Follette School of Public Affairs

Panelists:

- Menzie Chinn — professor of public affairs and economics

- Mark Copelovitch — professor of political science, public affairs, and international relations

- Tana Johnson ’01 — associate professor of public affairs and political science

- Jon Pevehouse — Vilas Distinguished Professor of Political Science: International Relations

Register here.

WSJ October Survey: Q3 Growth Revised Up, Q4 Down

In levels (incorporating revisions to actual GDP):

Deal/No Deal

Macro (GDP) implications of “no deal”.

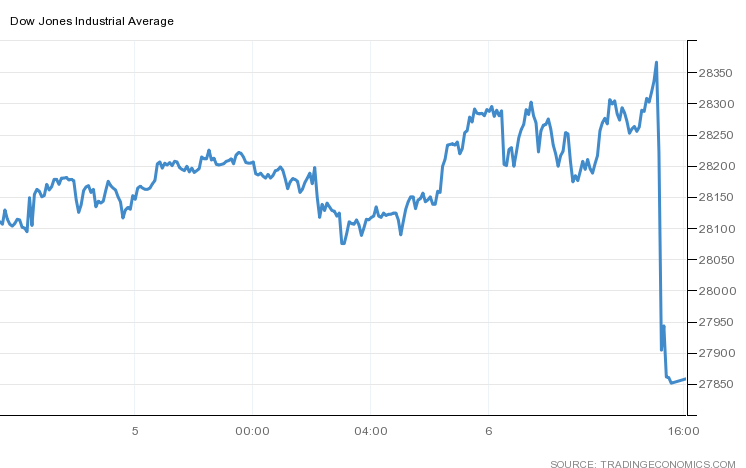

Wall Street Votes on Ending Covid Package Negotiations

The Hill (posted at 3:01 EDT):

President Trump said Tuesday that he has instructed his top aides to stop negotiating with House Speaker Nancy Pelosi (D-Calif.) on future coronavirus stimulus legislation until after the November election.

The Dow Jones:

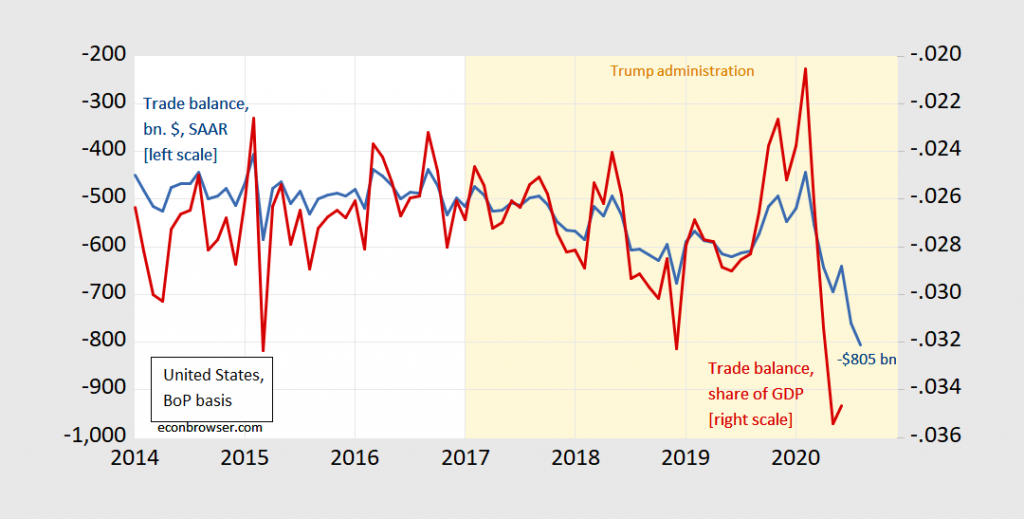

Still More Winning! “U.S. goods trade deficit in August hits record high”

Headline from Politico. From today’s trade release for August:

Figure 1: US trade balance, bn. $, SAAR (blue, left scale), as a share of GDP (red, right scale). Light orange shading denotes Trump administration. Nominal GDP interpolated quadratic match. Source: BuCensus/BEA via FRED, BEA, and author’s calculations.

Economists for Biden-Harris

More than 200 economists have signed a letter of support for Joe Biden and KamalaHarris. Signers include Nobel Prize winner Joseph Stiglitz, Laura Tyson,William Spriggs, Claudia Goldin, Robert Reich, Robert Gordon, Ebonya Washington, Jeff Sachs, and Emmanuel Saez. The letter contends that the U.S. is facing a series of simultaneous major crises — health, economic, and political — and that only strong national leadership from the Biden-Harris ticket supported by a grassroots democratic movement can address these crises and create an economy that works for all Americans.