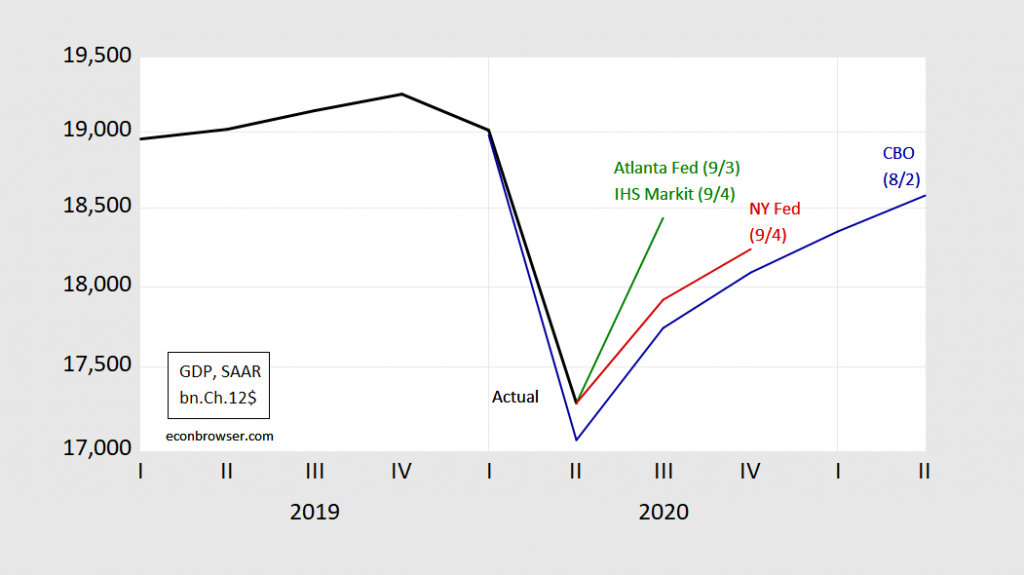

Two-thirds of the way through Q3.

Figure 1: Reported GDP (black), Atlanta Fed GDPNow (green), IHS Markit (green), NY Fed nowcast (red), CBO August projection (blue). Source: BEA 2020Q2 2nd release, GDPNow, IHS Markit, NY Fed, and author’s calculations.