On the Q4 Advance Release: GDP vs. “Core GDP” and Residential Investment

Yesterday, Jim moved the Econbrowser Little Econ Watcher’s countenance to neutral 😐, based primarily on Q3 growth, using the methodology outlined in this post. Remember, there will be two revisions for Q4 growth (before the annual revision, and succeeding revisions). What are some other readings from the Q4 release?

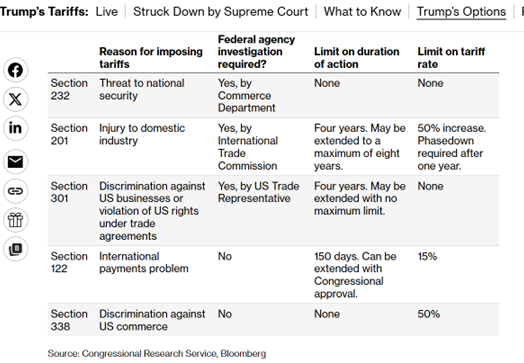

Where’s the Balance of Payments Emergency?

Section 122, invoked to place 10% tariffs, was written primarily to address balance payments issues under fixed exchange rates. By balance of payments accouting:

CA + FA +ORT ≡ 0, ORT is official reserves transactions, ORT > 0 implies decumulation.

So CA + FA < 0 requires total reserves to be decreasing. Is that the case?

GDP continues to grow

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 1.4% annual rate in the fourth quarter. That is a bit below the historical average growth of 3.1% and also below some analysts’ expectations for the Q4 numbers.

Continue reading

On the Eve of the 2025Q4 Advance Release

Jim will have examination of the GDP numbers tomorrow, but here is the picture as of today, in the wake of the international trade figures, industrial production, housing starts, yesterday and today.

Is Housing the Business Cycle (in 2026)?

Most indicators suggest growth in output, spending aggregates (while employment is trending sideways). Housing is suggested as a leading indicator by Leamer (2007, 2015), but less a leading indicator recently (Green, 2022). Here’s a picture of residential fixed investment, which on average leads economic activity by approximately 7 quarters:

2025 Trade Deficit at 2024 Levels

Total seasonally adjusted trade deficit averaged $75.1 mn, vs. 2024 $75.3 mn. The real goods trade deficit averaged $99.8 mn Ch.2017$ vs. 94.4 mn Ch.2017$. In other words, the real goods trade deficit increased (the same is true of the real goods ex-petroleum trade deficit).

Guest Contribution: “Usury laws and Trump’s proposed cap on credit card interest rates”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version was published in Project Syndicate.

Business Cycle Indicators: Output Surges ahead of Employment

Industrial and manufacturing production rise, surprising on the upside:

Output Gaps, Again

Primarily from the production function approach (discussion here).