I find it remarkable that, going by the numbers, economic policy uncertainty is now higher than after the bankruptcy of Lehman — and even higher than in the days after 9/11.

Economic consequences of Brexit

Here are my two pence on some of the consequences of Britain’s vote to leave the European Union.

Continue reading

Guest Contribution: “Does the Economy Really Do Better Under Democratic Presidents?”

Today, we are pleased to present a guest column written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. This is an extended version of a column appearing at Project Syndicate.

Looking at the UK Economy, Post-Brexit

Here are some assessments of the economic impact on the UK economy, over the short (business cycle horizon) to long run.

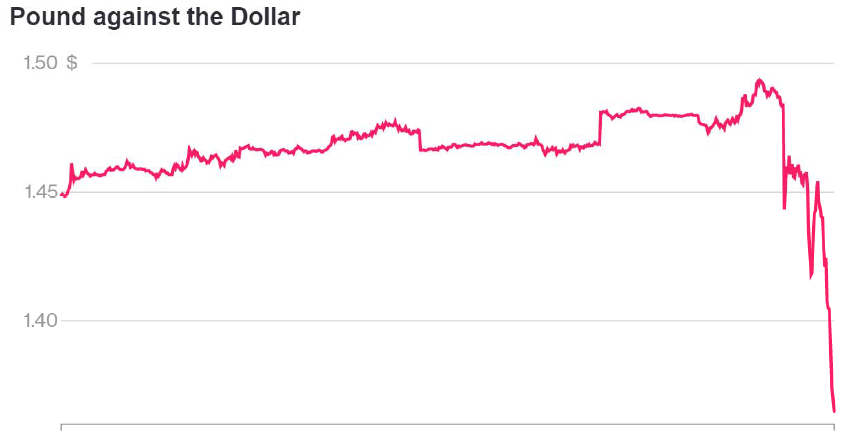

The Pound, 4AM London Time

Kansas and Her Neighbors: GDP Edition

Some critics (e.g., [1]) have argued that employment and coincident indicators are too narrow of measures of economic activity to make relevant comparisons. Here I plot the real GDP — the broadest measure of economic activity — for Kansas and her neighbors.

Guest Contribution: “The Effects of Unconventional and Conventional U.S. Monetary Policy: The Role of Expected Inflation”

Today we are pleased to present a guest contribution by Yi Zhang, Ph.D. candidate at the University of Wisconsin-Madison. This post draws upon this paper.

Drumpfarmageddon, Tabulated

Heretofore, I’ve approached in a piecemeal manner the assessment of the impact of massive tax cuts for the wealthy, building a really, really great wall, a final solution for the presence of undocumented immigrants, and the imposition a 45% tariff on Chinese imports. Moody’s Mark Zandi et al. have now done the hard work of trying to figure out what the macro impacts would be to implementing Mr. Trump’s agenda.

Contextualizing the North Carolina Experience

Defenders of the Kansas and Wisconsin misadventures in supply side economics keep on pointing to North Carolina as the counter-example that proves tax cuts do prompt faster growth (e.g., [1] [2]). A quick look at the data provides the following observations: (1) North Carolina GDP growth has merely matched nationwide growth since 2013Q1, (2) NC GDP has just been revised downward so that 2015Q3 GDP is now 1.5% lower than previously thought, and (3) NC GDP is less than the counterfactual indicated by historical correlations with national GDP.

No, I Don’t Think This Is the Reason BEA is Predicting a Massive Downward Revision in GDP

Political Calculations arrives at an alarming conclusion that real GDP will be downwardly revised by a large amount when the annual benchmark revision comes out in July.