The Wisconsin Department of Workforce Development trumpeted May figures today. What if the relationship between US and Wisconsin employment over the 1994-2009M06 period persisted into the Walker era? We would have expected 60,000 more jobs than we got.

Mass Shooting Casualties, by Religion of Perpetrator: Muslim vs. Non-Muslim, Updated

A previous post on mass shooting casualties has been widely circulated. Here I update to include recent data, and to normalize by population. An upward trend indicates the incidence of casualties is rising.

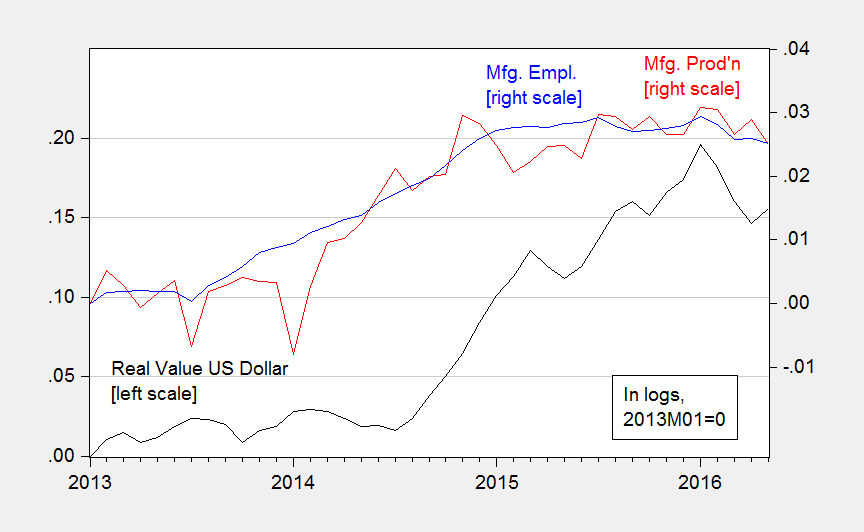

Manufacturing and the Dollar’s Value

New industrial output numbers, including for manufacturing, confirm a slowdown in at least part of the tradables sector.

Figure 1: Real value of the US dollar against broad basket (black, left scale), manufacturing production (red, right scale), manufacturing employment (blue, right scale), all in logs, 2013M01=0. Source: Federal Reserve Board, BLS, and author’s calculations.

Both production and employment now on a slight downturn, despite recent dollar depreciation. The dollar is 14% higher in log terms relative to mid-2014.

Kansas in (Technical) Recession

The BEA released quarterly state GDP figures today. As of 2015Q4, Kansas has just experienced two consecutive negative GDP growth, a distinction shared with only three other states — Alaska, Oklahoma and Wyoming (North Dakota experienced three quarters of negative growth, but experienced positive growth in Q4). Over the past five quarters, Kansas has experienced four quarters of negative GDP growth.

Recession Risks: The View from Wall Street Economists

The Wall Street Journal‘s June survey of economists is out. Interestingly, no one’s mean forecast is for two quarters of negative growth in 2016Q2-Q3 (or even one quarter!), but the assigned probabilities of recession remain elevated.

Data Paranoia Watch: Employment Edition

Which one of these texts is drawn from a real article?

Thinking about Wages, Inflation and Productivity… and Capital’s Share

On the release of the Productivity and Costs release, the WSJ reports “Weak Productivity, Rising Wages Putting Pressure on U.S. Companies: Economists fret how trends may affect inflation and broader growth”.

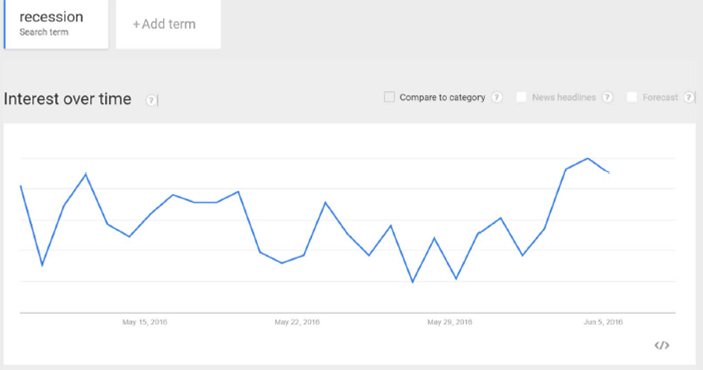

Recession Watch, June 2016

Since Friday’s employment release, [1] there’s been a surge in articles discussing the possibility of a recession.

Figure 1: Google Trends index for “Recession”, last 30 days, in Business and Finance category. Source: Google, accessed 6/7, 11PM Pacific.

Time for a look at some key indicators the NBER Business Cycle Dating Committee [1] has looked at in the past.

Guest Contribution: “China Should Rebalance by Following the Fed”

Today we are pleased to present a guest contribution written by Gunther Schnabl, Professor of Economics and Business Administration at Leipzig University.

Currency Misalignment, 2016: FEER vs. Penn Effect

The Peterson Institute for International Economics’ William Cline has just published estimates of equilibrium exchange rates for May 2016; the USD is 7% overvalued, while the Chinese yuan (CNY) is at its “FEER level”.