Not so certain the slowdown will be similarly erased.

China: The Trilemma and Reserves, Again

From Bloomberg:

The yuan strengthened after China’s central bank raised its fixing for a fourth day and data showed a less-than-estimated drop in the nation’s foreign-exchange reserves.

Senator Sanders and Financial Regulation

Today I was reminded that Senator Sanders voted against TARP. That made me conclude that Senator Sanders’ position on financial regulation is truly unique.

[graphic update 3/8 10:15 pm Pacific]

Continue reading

Spreads and Recession Watch, March 2016

Five Thirty Eight warns us to prepare for a (not likely imminent) recession; Wall Street Journal‘s Real Time Economics cautions “All Clear on Recession Risk? Not Yet”, even if the latest employment indicate continued growth. Time to review market indicators of the outlook.

Visualizing Textbook and Alternative Interpretations of the Friedman Analysis of the Sanders Economic Plan

Now that the dust has (kind of) settled on exactly what is and is not in Gerald Friedman’s interpretation of the Sanders economic plan, I thought it useful to contrast the textbook (at least the one I use, Olivier Blanchard/David Johnson‘s) view of how a fiscal stimulus works, versus that in which a one-time spending increase yields a permanent increase in output, in a graphical format.

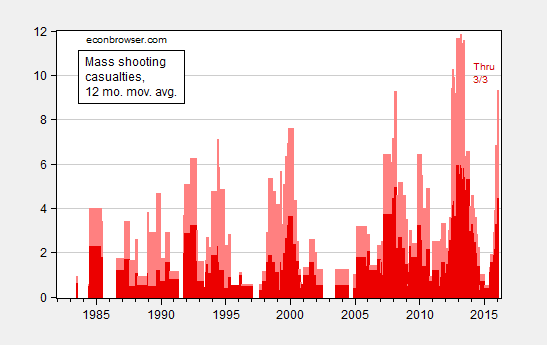

Mass Shooting Statistics, 3/3/16

Figure 1: 12 month moving average of mass shooting casualties; deaths (dark red), wounded (pink). Source: Mother Jones, GunViolenceArchive.org. for 2/26/2016 data, and author’s calculations.

For a per capita depiction, see this post. The upward trend is obvious there as well.

“Is Currency Devaluation Overrated?”

That’s the title of a symposium in the current issue of The International Economy. Martin Feldstein, Ted Truman, Joe Gagnon, Bill Cline, Mohamed El-Erian, Cathy Mann, and José de Gregorio (among many others) contribute.

Economic Slack, Again

I keep on seeing comparisons between the Great Depression and the Great Recession (e.g., [1]), and how a big fiscal stimulus could result in a big and sustained jump in output. I think it useful to visually compare the extent of downturn in both cases.

Forward guidance

According to economic theory, one of the most promising ways in which monetary policy might be able to stimulate an economy in which the nominal interest rate has reached zero is to promise to follow a different policy rule once interest rates are again positive. A commitment to more stimulus and inflation in the future regime could in principle influence expectations and actions of people in the economy today, and thereby offer a means by which the central bank could help an economy recover from the zero lower bound. But as a practical matter, how does the Fed communicate to the public at date t something it intends to do at some future date t+h?

Continue reading

Guest Contribution: “Who is right on US financial reform? Sanders, Clinton, or the Republicans?”

Today we are pleased to present a guest contribution written by Jeffrey Frankel, Harpel Professor of Capital Formation and Growth at Harvard University, and former Member of the Council of Economic Advisers, 1997-99. This post is an extended version of a column that appeared in Project Syndicate.