On Wednesday the Federal Reserve announced that it is increasing its target for the fed funds rate to a new range of 25 to 50 basis points (0.25% to 0.5% annual rate). How does the Fed plan to accomplish this, and what does it mean for other interest rates?

Continue reading

Guest Contribution: “U.S. Monetary Expectations and Emerging Market Debt Flows”

Today we are fortunate to have a guest post written by Eric Fischer, PhD candidate at the University of California, Santa Cruz.

Links for 2015-12-13

Quick links to a few items I found interesting.

Continue reading

Guest Contribution: “Does legislating a rule for the Federal Reserve make sense?”

Today we are fortunate to have a guest contribution written by Carl E. Walsh, Distinguished Professor of Economics at the University of California, Santa Cruz.

Estimating Shock Dependent Exchange Rate Pass-Through

We propose a new focus: incorporating the underlying shocks that cause exchange rate fluctuations when evaluating how these fluctuations ‘pass through’ into import and consumer prices.

Mass Shooting Casualties, by Religion of Perpetrator: Muslim vs. Non-Muslim

Update, 6/12/2016, 4:15PM Pacific:

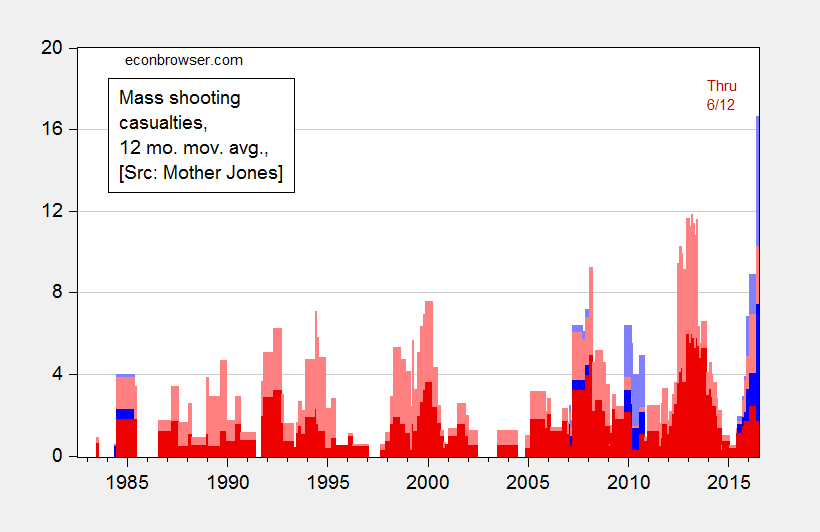

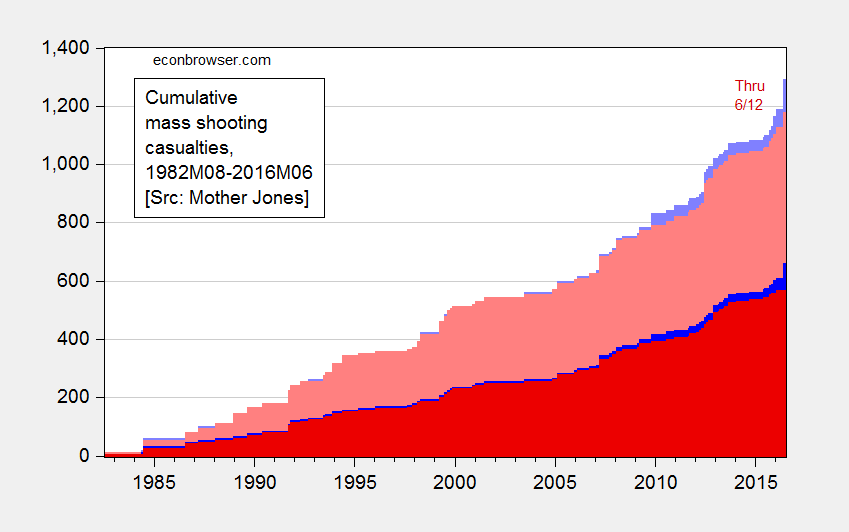

Here are two figures, with data updated to 6/12.

Figure 0a: 12 month moving average of mass shooting casualties; deaths inflicted by non-Muslims (dark red), wounded inflicted by non-Muslims (pink), deaths inflicted by Muslims (dark blue), wounded inflicted by Muslims (light blue). June observation for data through June 12. Source: Mother Jones, news reports for June 2016 and author’s calculations. Tabulations of religion of perpetrator by author.

Figure 0b: Cumulative sum of mass shooting casualties, beginning in 1982M08; deaths inflicted by non-Muslims (dark red), wounded inflicted by non-Muslims (pink), deaths inflicted by Muslims (dark blue), wounded inflicted by Muslims (light blue). June observation for data through June 12. Source: Mother Jones, news reports for June 2016 and author’s calculations. Tabulations of religion of perpetrator by author.

Factors in long-term unemployment

The BLS reported on Friday that the U.S. unemployment rate was down to 5% in October and November, its lowest level since 2008.

Continue reading

NYT: “Donald Trump Calls for Barring Muslims From Entering U.S.”

That’s the headline from the NY Times. Given this development, I’m going to save Donald Trump some time in writing up the legislation. Here is some handy-dandy text borrowed from the Chinese Exclusion Act of 1882.

The Minnesota-Wisconsin Divergence in Family Income Continues

The American Community Survey data for 2014 are out (h/t Samuel). Real household family income in Wisconsin continues to decline relative to that in Minnesota.

Wisconsin Employment Exceeds March 2008 Levels

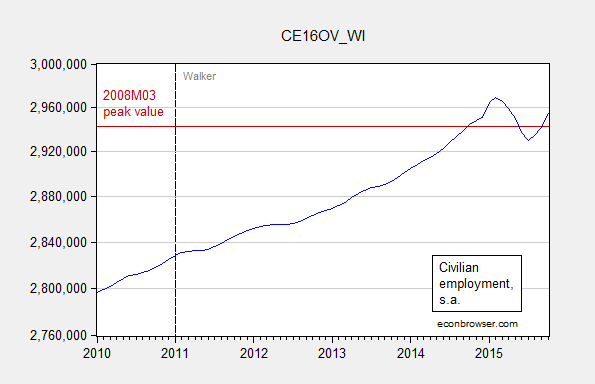

In an op-ed published yesterday, entitled “Wisconsin is working and growing jobs”, Governor Walker wrote:

More people are working in Wisconsin today than at just about any other time in our history.

This is correct. According to BLS statistics, in October Wisconsin civilian employment rose above March 2008 levels. They are still 13,855 below levels recorded in February of this year. This is why the Governor had to include the proviso “just about any other time”.

Figure 1: Wisconsin civilian employment, seasonally adjusted (blue), 2008M03 peak value (red horizontal line). Source: BLS.

As noted by Justin Wolfers, household surveys based estimates at the state level are subject to high levels of uncertainty. This doesn’t stop some people from citing state-level unemployment rates almost to the point of excluding other estimates. But it should — or at least make people a little reticent about unemployment-rate based boosterism, as we have heard from certain quarters.

For discussion of the trends in the establishment series, see here. To see how far Wisconsin nonfarm payroll employment has lagged what should have been expected given historical correlations, see this post (hint: Wisconsin lags, and statistically significantly so).

This lackluster performance is likely why “…57 percent of voters said that they think Wisconsin is lagging other states in job creation”, according to a Marquette University Law School poll (WPR).