ADP private nonfarm change at 742K below consensus of 800K (Bloomberg).

US Agriculture and the Global Economy

Some recent research from the agency Mr. Trump found too meddlesome, and Mr. Mulvaney tried to dispatch (i.e., the USDA’s Economic Research Service):

Distributional Data from the National Income and Product Accounts

Using an incredibly powerful device called “the Google”, I have discovered new prototype data releases regarding the distributional aspects of real personal income. Here are some figures depicting income accruing to select household income percentiles, contributions to income growth therefrom, and Gini coefficients. These figures are from this Working Paper entitled “Measuring Inequality in the National Accounts” (updated 2020).

Inomics: Top Economics Blogs – April 2021

From Inomics:

Business Cycle Indicators as of May 4th

Monthly GDP figures were released by IHS-Markit yesterday, showing a rebound in March. In the context of key macro indicators followed by the NBER Business Cycle Dating Committee:

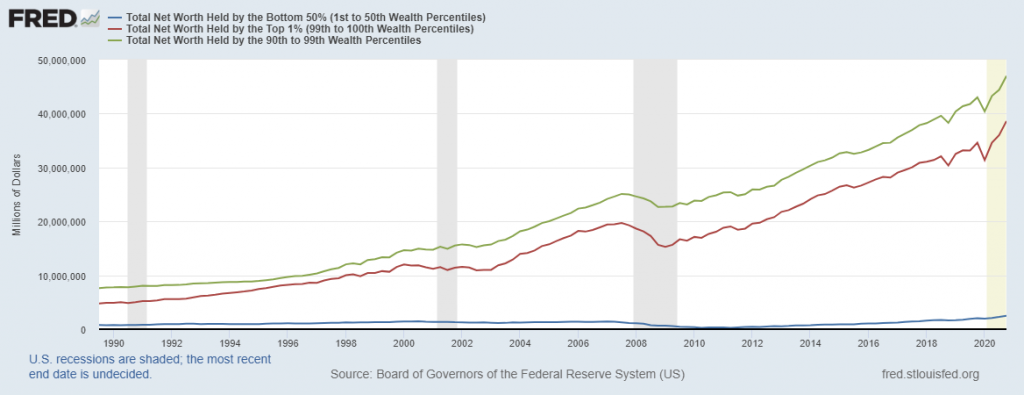

Net Worth for Bottom 50% and Above

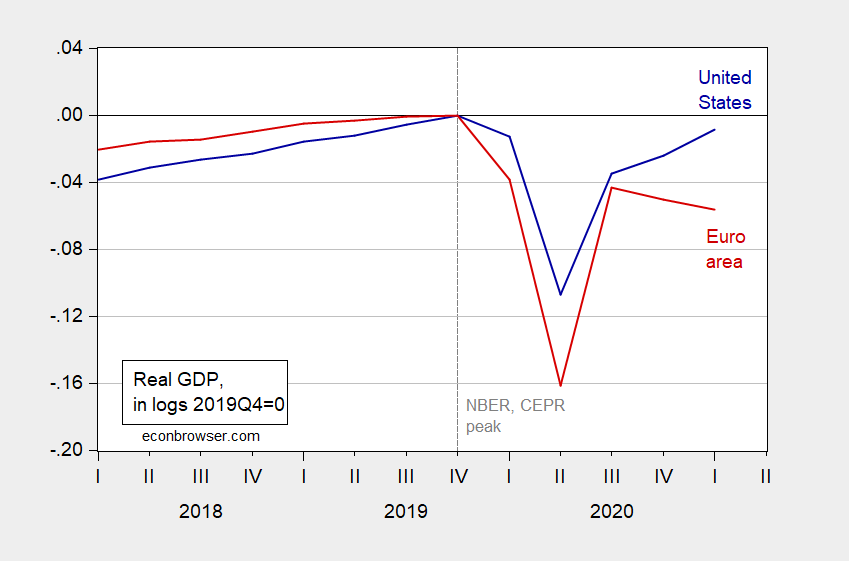

Diverging Fortunes: US and Euro Area GDP

Euro area GDP continues to drop in Q1, while the US recovery accelerates.

Figure 1: US real GDP (blue), Euro Area 19 real GDP (red), both in logs, 2019Q4=0. Source: BEA, European Union, and author’s calculations.

The US recovery has benefited from a tremendous amount of fiscal stimulus and — finally — a reasonable pandemic response (including an effective vaccination rollout).

The Composition of Consumption

While aggregate consumption has surpassed peak levels, it hasn’t returned to trend. Furthermore, the composition has changed drastically.

Economy looks strong

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 6.4% annual rate in the first quarter, well above the 3.1% average growth that the U.S. experienced over 1947-2019.

Nowcasts, Economic Indicators, Expectations

On the eve of the advance GDP release for Q1.