From the American Institute for Economic Research, compared to CPI, and CPI for fast food…

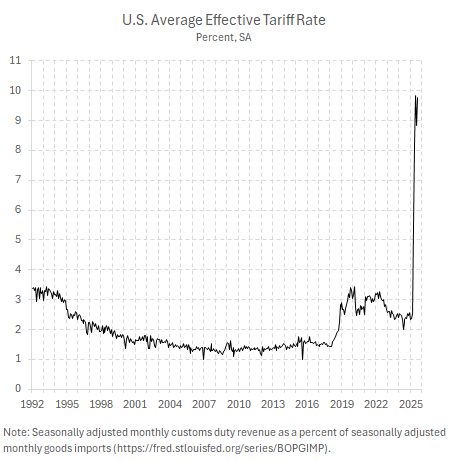

Miran: “I don’t see any material inflation from tariffs…”

From CNN. OK.

Stephen Moore Remains Blithely Detached from Reality: Tax Cut Impacts

From Swagel, “CBO’s Estimates of the 2017 Tax Act: Growth and Revenues” released today:

CBO’s April 2018 projections of revenues in 2018 and 2019 were remarkably

accurate.Actual federal revenues in 2018 and 2019 were 99.8 percent and 99.2 percent of

the amounts that CBO projected. In other words, CBO was very slightly

overoptimistic about revenues in the years after enactment of the 2017 tax act,

and the agency’s revenue projection errors for those years were much smaller

than average.

Wisconsin Manufacturing Employment Declines in August

From DWD release today:

Civilian Employment Peaked in April 2025

So too has CPS series adjusted to NFP concept, a series pushed in the wake of the slow employment recovery from the 2001 recession. On the other hand, preliminary benchmark NFP, and NFP estimated using QCEW data continue to crawl upward.

EJ Antoni ‘s “Sustainable” Employment Measure Is in the Red

EJ Antoni noted a year ago (Sept 6, 2024):

gov’t and the gov’t-dominated healthcare sector [employment growth].. it’s all tax-payer funded, and it’s not at all sustainable

One of These Is Not Like the Others – Messages from the FOMC SEP

FOMC votes to reduce the Fed funds rate by 25bps with one dissent (Stephen Miran, on loan from CEA), who argued for 50 bps decline.

Business Cycle Indicators at Mid-September

Industrial and manufacturing production, and retail sales, all beating consensus. Nonetheless, there’s a tendency toward trending sideways.

The Danger of Fed Credibility under Assault

If credibility is degraded, then tariff induced cost-push shocks are less likely to manifest as one-off price level increases, and more likely to spur a bout of inflation.

WisPolitics/Wisconsin Technology Council: “How tariffs are affecting Wisconsin’s economy”

Video of proceedings tomorrow (Tues, 9/16) on WisconsinEye [link updated 9/17].

Source: Pawel Skrzypczynski, accessed 9/14/2025.