I read some triumphalist claims that Covid-19 fatalities are declining. I want to remind readers about the hazards of interpreting (1) administrative data, and (2) data revisions.

September Economic Forecasts: Uncertainty Dominates at Year End

“Scott Walker: Wisconsin’s agricultural, manufacturing jobs would be ‘devastated’ under Biden leadership”

That’s title of a FoxNews article. Like all things emanating from the former governor, you have to look at the data to assess. Let’s consider first agriculture under Walker.

August Wisconsin Employment: Continued Slow Recovery?

My guess, based on a first differences specification of Wisconsin employment on national, in logs, 2019-2020M07.

Covid-19 Fatalities, Excess Fatalities, and Conspiracies

In the latest conspiracy theory, some have argued that since only about 6% of Covid-19 fatalities state solely Covid-19 as a cause of death, pandemic fatalities are incredibly overstated. Inspection of the statistics suggest reported Covid-19 fatalities are, if anything, understating pandemic fatalities.

Guest Contribution: “Robots and Labor Demand: Evidence from Japan”

Today we are fortunate to present a guest contribution written by Robert Dekle, Professor of Economics at USC.

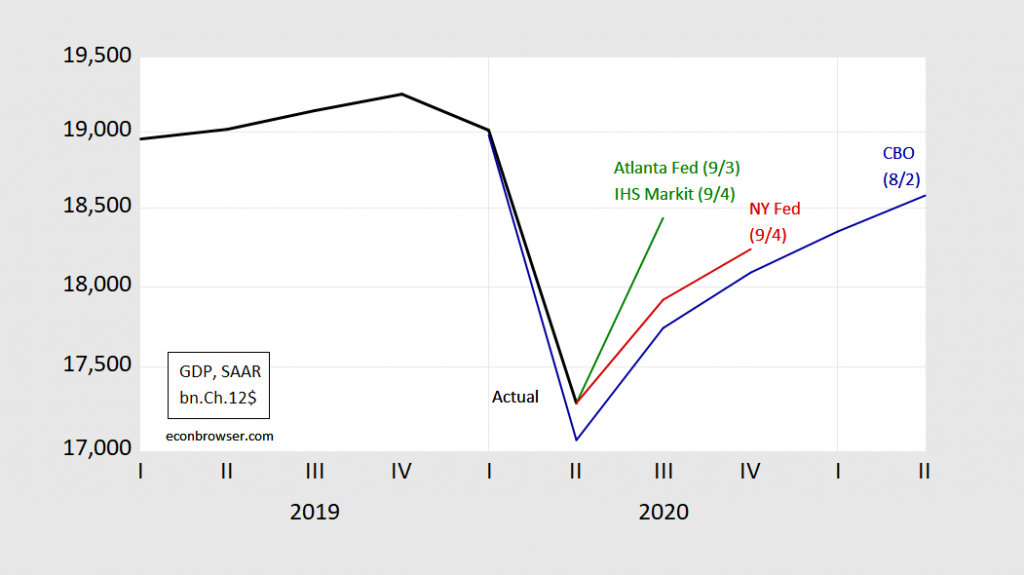

Nowcasts

Two-thirds of the way through Q3.

Figure 1: Reported GDP (black), Atlanta Fed GDPNow (green), IHS Markit (green), NY Fed nowcast (red), CBO August projection (blue). Source: BEA 2020Q2 2nd release, GDPNow, IHS Markit, NY Fed, and author’s calculations.

How Great Are Things for Wisconsin’s Farmers?

It was surprising to me to see a Wisconsin farmer singing the praises of Mr. Trump’s policies. From WPR:

Business Cycle Indicators, September 4th

With today’s employment situation release, here’s a picture of five indicators tracked by the NBER’s Business Cycle Dating Committee (BCDC):

Trade Deficit Surges During the Recession

The trade balance hit -$63.6 billion (monthly, seasonally adjusted) in July. The trade balance has been deteriorating since the recession began, in contrast to what usually happens — an improvement in the trade balance, as imports decline with a decline in domestic economic activity.