Last week I puzzled over the response of financial markets to the U.S. election. Since the election, the S&P500 is now up 3%, the dollar is up 4.6% against the euro, and most remarkable of all, the 10-year Treasury rate has gone up 50 basis points. Here I offer some further thoughts on the last development.

Continue reading

Further Dollar Appreciation?

As noted in my last post, the collision of expansionary fiscal and counter-cyclical monetary policy will result in an appreciated dollar. How much more appreciated?

Mr. Trump and the markets

I was astounded not only by the outcome of the U.S. presidential election but also by the response of financial markets.

Continue reading

Implications for the Agricultural Economy of Fiscal Policies Proposed by President Elect-Trump

In short: Rural areas will not like what they get from a combination of expansionary fiscal/counter-cyclical monetary policy.

Guest Contribution: “What Will the Trump Presidency Look Like?”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared on November 9th in Project Syndicate.

Economic Policy Uncertainty, November 14

Figure 1: Daily economic policy uncertainty (blue), and centered 7 day moving average (red). Source: PolicyUncertainty, accessed 14 Nov 2016, and author’s calculations.

Today’s value (sure to be revised) exceeds that recorded on 9/18/2001, the previous high in the sample running from 1985 to today.

Links for 2016-11-13

Three papers of interest on the effects of U.S. trade policy on manufacturing employment, racial discrimination, and the Chinese real estate boom.

Continue reading

Thank Goodness We Solved that Problem of Elevated Economic Policy Uncertainty Depressing Growth!

As of today, measured economic policy uncertainty hit 468.

Continue reading

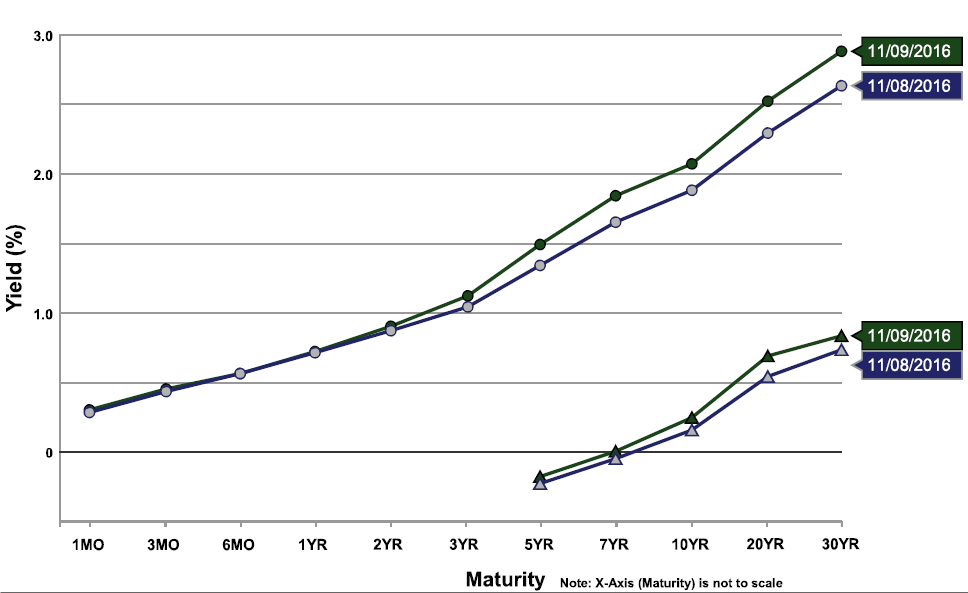

At Long Last, the Feared (Portfolio) Crowding Out Has Materialized

The implication of a (massive) revision to the expected path of government debt relative to baseline is an increase in the slope of the yield curve. Some portion comes from the expectations hypothesis of the term structure, some from an increase in the risk premium. [lecture notes on portfolio crowding out] [lecture notes on expectations hypothesis of term structure]

Figure 1: Yield curve as of 8 November (blue), and 9 November (green). Source: US Treasury.

Today, and Eight Years Ago

Here are graphs of employment, industrial production, personal income ex.-transfers, manufacturing and trade sales, and real GDP (five indicators that the NBER Business Cycle Dating Committee has focused on in the past) depicting the state of the macroeconomy, given what we know today, and compared to eight years ago.