* “After Trump” .

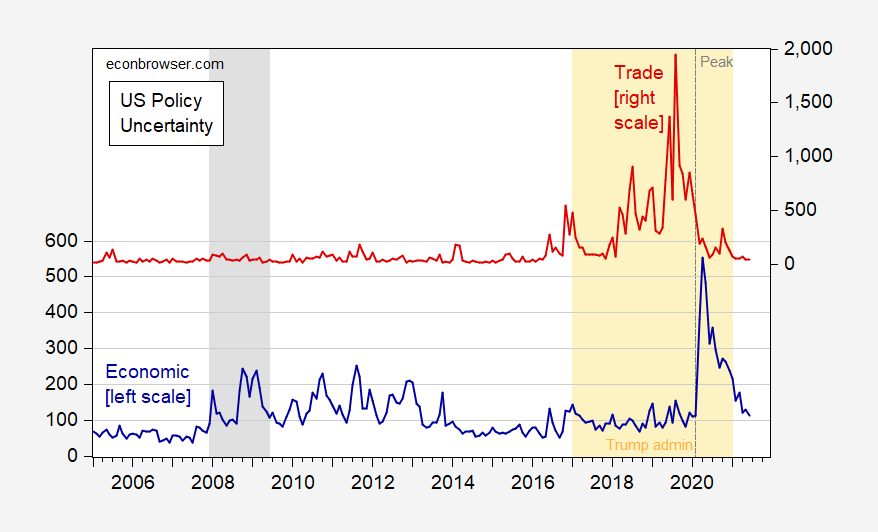

Figure 1: US Economic Policy Uncertainty index (news) (blue, left scale), US Trade Policy Uncertainty categorical index (red, right scale), both monthly averages of daily data. NBER defined recession dates shaded gray, NBER peak at dashed line; orange denotes Trump administration. Source: policyuncertainty.com, and NBER.

Part of this decline in uncertainty could be attributable to the economic management team.