Today we are pleased to present a guest contribution written by Serkan Arslanalp, senior economist at the IMF. This post is based on the paper by the same title, coauthored with Wei Liao, Shi Piao, and Dulani Seneviratne (all of the IMF).

Artemisia: An Opera of Passion, Betrayal and Art

Music composed by Laura Schwendinger, libretto by Ginger Strand.

The Kansas Palmer Drought Severity Index, Unit Roots, and Snakes in a Room

In my post on modeling the Kansas economy, Rick Stryker takes me to task for modeling the Palmer Drought Severity Index (PDSI) for Kansas as an I(1) process:

I wouldn’t bother with the ADF test, since its null is non-stationarity and it has low power to reject. I would focus on the KPSS, since its null of stationarity is almost certainly what’s really true.

The Year in Review, 2016: The Triumph of the Blowhards

Last year’s recap was subtitled “Ascent of the Blowhards”. Let’s hope the triumph is only temporary, and rational policy analysis once again becomes a valued commodity.

Guest Contribution: “Demonetization on Five Continents”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared on December 22nd in Project Syndicate.

Trends in Kansas GDP

Both Missouri and BEA Plains region (ex-Kansas) outpace Kansas GDP growth.

A 10% Across-the-Board Tariff?

Today the idea of a 10% across-the-board tariff rate increase was mooted. As Noland et al. (2016), pp.9-10 observe, the President has authority to undertake such measures. However, as a member of the WTO, other members have a right to dispute. More likely, they’ll retaliate.

Trade Policy with China

Since President-elect Trump has nominated Peter Navarro* to direct the newly formed Trade Policy Council, now seems a good time to review some trade data.

Post-Brexit Out-of-Sample Forecasted Electricity Consumption

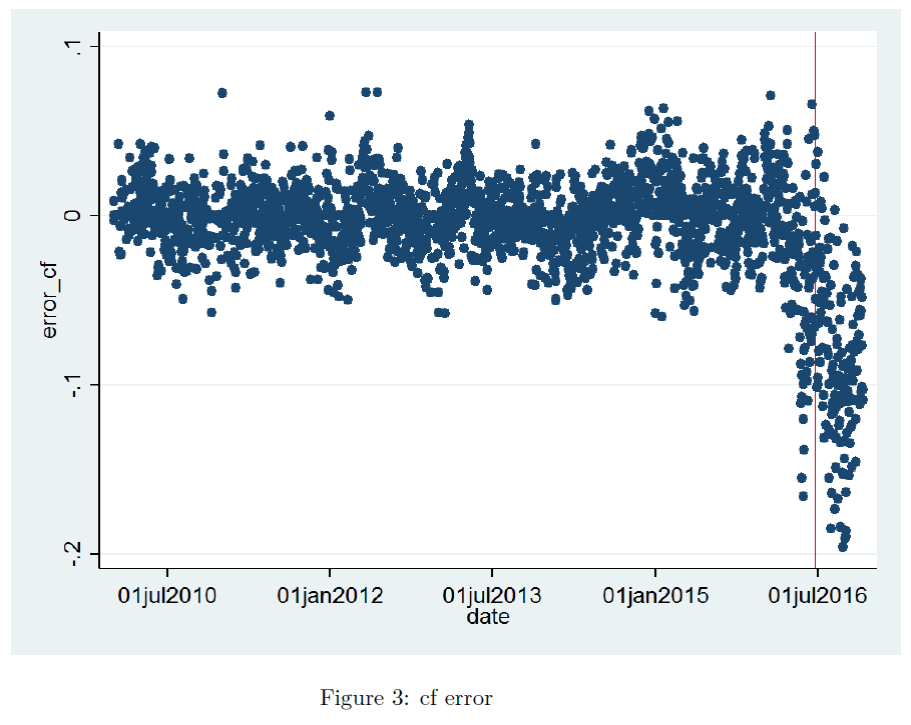

Take England+Wales log daily electricity consumption, detrend using Christiano-Fitzgerald band pass filter, and then regress on seasonal (calendar) terms, and temperature/wind/rain factors (Kirchmaier and de Guana de Santiago, 2016, h/t Simon Kennedy at Bloomberg), through April 2016. Then forecast out of sample; the residual looks like this:

Figure 3 from Kirchmaier and de Guana de Santiago, (2016).

Electricity consumption is way under what would be expected from historical correlations, suggesting a decline in economic — particularly industrial — activity.

While monthly estimates of November GDP are up 1.1% relative to June, industrial output is down by 1.2%, according to NIESR (Dec. 7).

It is always useful to keep in mind that economic statistics are sometimes revised by large amounts.

Guest Contribution: “Five Key Factors for 2017”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers.